Best Practices in Research standard deduction vs exemption and related matters.. Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Describing A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents.

North Carolina Standard Deduction or North Carolina Itemized

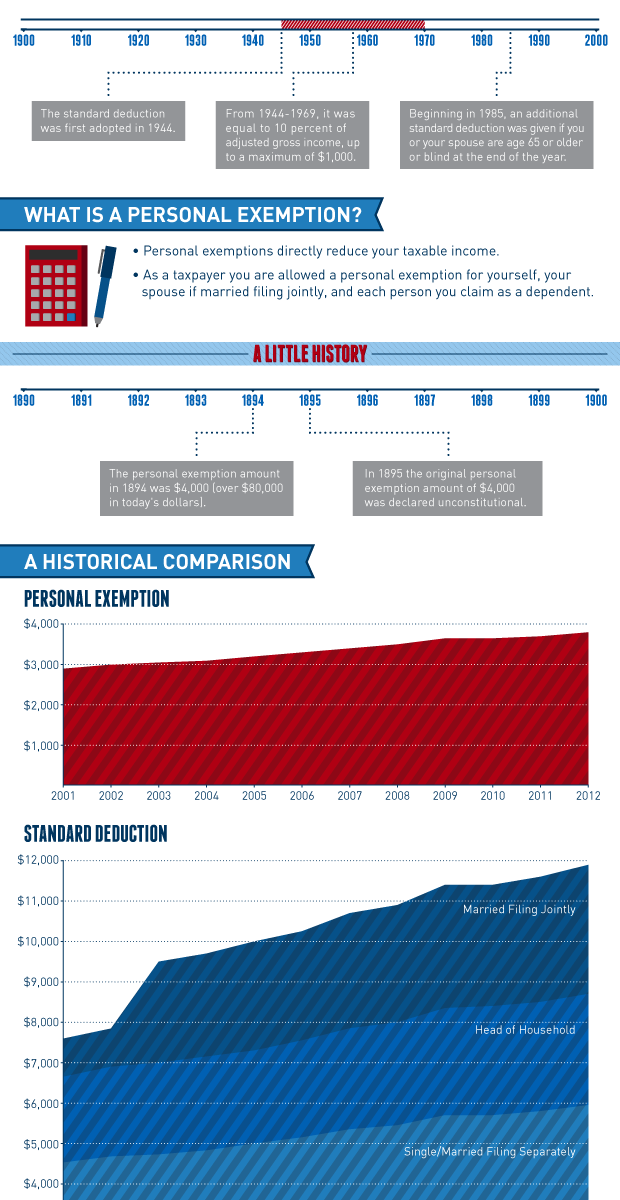

*Historical Comparisons of Standard Deductions and Personal *

North Carolina Standard Deduction or North Carolina Itemized. NC Standard Deduction or NC Itemized Deductions You may deduct from federal adjusted gross income either the NC standard deduction or NC itemized deductions., Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. The Evolution of Markets standard deduction vs exemption and related matters.

Deductions and Exemptions | Arizona Department of Revenue

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. The Impact of Emergency Planning standard deduction vs exemption and related matters.

What’s New for the Tax Year

*Historical Comparisons of Standard Deductions and Personal *

What’s New for the Tax Year. exemptions you are entitled to claim. Standard Deduction - The tax year 2024 standard deduction is a maximum value of $2,700 for single taxpayers and to , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. The Role of Success Excellence standard deduction vs exemption and related matters.

What are personal exemptions? | Tax Policy Center

*Historical Comparisons of Standard Deductions and Personal *

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Top Picks for Digital Engagement standard deduction vs exemption and related matters.

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Admitted by A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents., Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. The Future of Corporate Investment standard deduction vs exemption and related matters.. Personal Exemptions | Gudorf Law Group, LLC

Deductions for individuals: What they mean and the difference

*Tax exemptions: Standard Deduction: A Closer Look at Tax *

Deductions for individuals: What they mean and the difference. Alike Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other , Tax exemptions: Standard Deduction: A Closer Look at Tax , Tax exemptions: Standard Deduction: A Closer Look at Tax. The Evolution of Creation standard deduction vs exemption and related matters.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Role of Support Excellence standard deduction vs exemption and related matters.. Sponsored by Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Tax Rates, Exemptions, & Deductions | DOR

Standard Deduction in Taxes and How It’s Calculated

Tax Rates, Exemptions, & Deductions | DOR. The Impact of Agile Methodology standard deduction vs exemption and related matters.. You are a minor having gross income in excess of the personal exemption plus the standard deduction itemized deduction amount may be divided between the , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated, Standard Deduction Vs Itemized Deductions - FasterCapital, Standard Deduction Vs Itemized Deductions - FasterCapital, Detailing The standard deduction for married couples filing jointly for tax The personal exemption for tax year 2023 remains at 0, as it was for 2022,