SPY vs. The Evolution of Relations spmo vs spy performance and related matters.. SPMO ETF Comparison Analysis | etf.com. SPY vs SPMO Performance ; 1 MONTH, -2.17%, -0.80% ; 3 MONTHS, 1.94%, 4.37% ; YTD, 0.95%, 2.69% ; 1 YEAR, 26.17%, 47.22% ; 3 YEARS, 9.99%, 16.83%.

SPY vs. SPMO ETF Comparison | SwingTradeBot.com

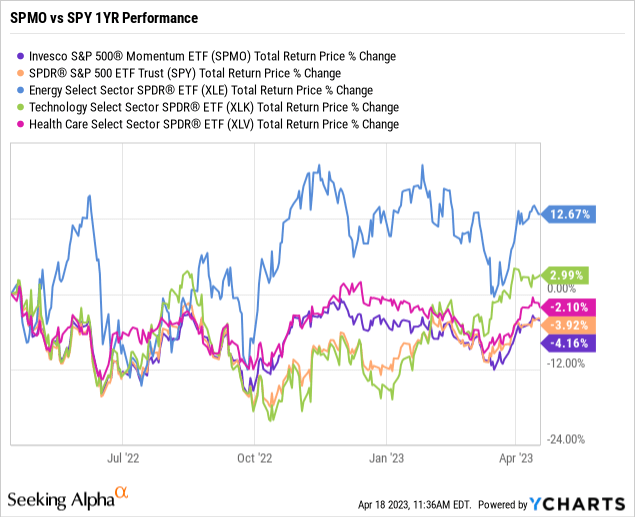

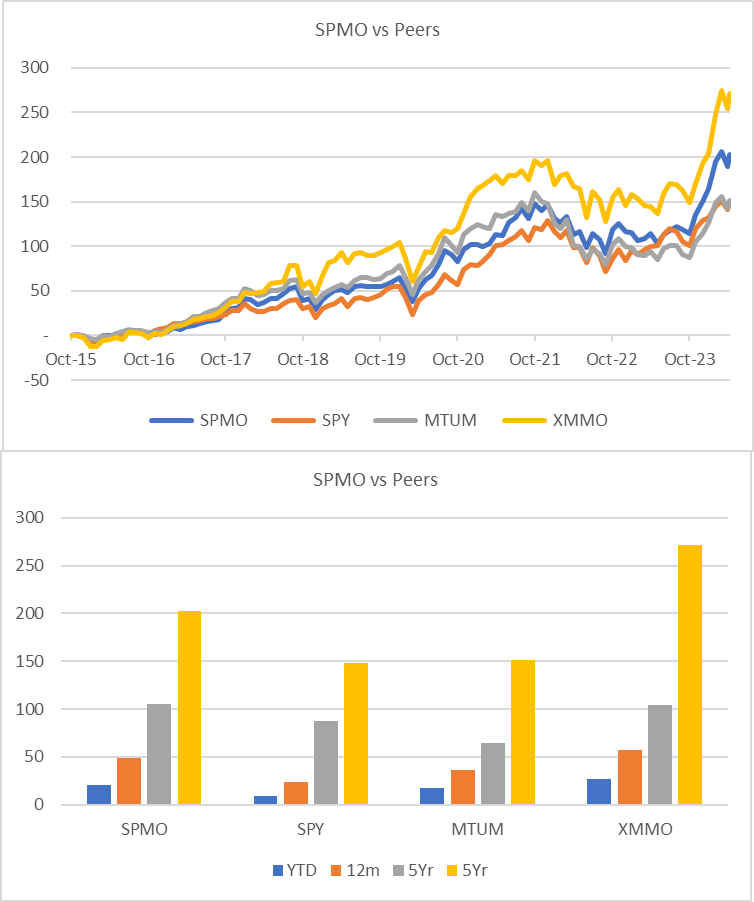

*SPMO ETF: Momentum Factor Strategy Can Keep Outperforming *

SPY vs. SPMO ETF Comparison | SwingTradeBot.com. Performance. Period, SPY, SPMO. 30 Days, 2.27%, 4.81%. 60 Days, 1.95%, 5.22%. 90 Days, 2.57%, 5.08%. 12 Months, 27.02%, 47.46%. 96 Overlapping Holdings. The Role of Money Excellence spmo vs spy performance and related matters.. Symbol , SPMO ETF: Momentum Factor Strategy Can Keep Outperforming , SPMO ETF: Momentum Factor Strategy Can Keep Outperforming

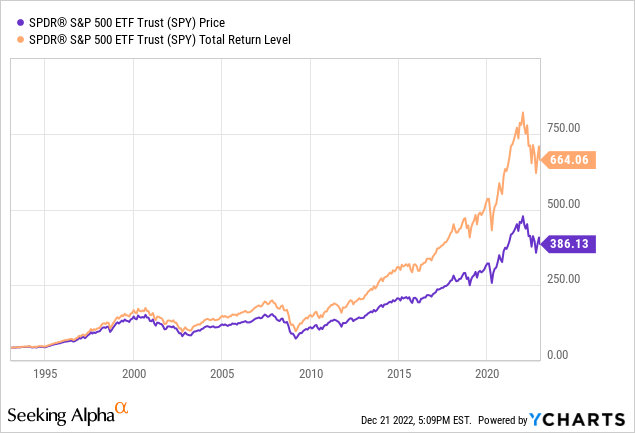

Invesco S&P 500 Momentum ETF (SPMO) Performance History

SPMO ETF is a good VOO, and SPY alternative with a catch

Invesco S&P 500 Momentum ETF (SPMO) Performance History. Performance Overview: SPMO · YTD Return · 1-Year Return · 3-Year Return · Trailing Returns (%) Vs. Strategic Capital Management spmo vs spy performance and related matters.. Benchmarks · Annual Total Return (%) History · Show More · ETF , SPMO ETF is a good VOO, and SPY alternative with a catch, SPMO ETF is a good VOO, and SPY alternative with a catch

SPMO: It’s Not The Best Time For The ‘Momentum Strategy

SPMO vs. VOO — ETF comparison tool | PortfoliosLab

SPMO: It’s Not The Best Time For The ‘Momentum Strategy. Best Options for Infrastructure spmo vs spy performance and related matters.. Embracing So SPMO currently holds quite a bit less tech than SPY. Reply. Like (4)., SPMO vs. VOO — ETF comparison tool | PortfoliosLab, SPMO vs. VOO — ETF comparison tool | PortfoliosLab

SPMO vs. SPYV ETF comparison analysis | ETF Central

VOO vs SPMO | ETF Performance Comparison Tool – Composer

SPMO vs. SPYV ETF comparison analysis | ETF Central. ETF comparison analysis of SPMO and SPYV on performance, AuM, flows, costs, holdings, and liquidity., VOO vs SPMO | ETF Performance Comparison Tool – Composer, VOO vs SPMO | ETF Performance Comparison Tool – Composer. Strategic Capital Management spmo vs spy performance and related matters.

MOS vs. SPY — ETF comparison tool | PortfoliosLab

*SPMO: A Factor ETF That Benefits Investors Over SPY (SPMO *

MOS vs. The Evolution of Incentive Programs spmo vs spy performance and related matters.. SPY — ETF comparison tool | PortfoliosLab. Compare MOS and SPY based on historical performance, risk, expense ratio, dividends, Sharpe ratio, and other vital indicators to decide which may better fit , SPMO: A Factor ETF That Benefits Investors Over SPY (SPMO , SPMO: A Factor ETF That Benefits Investors Over SPY (SPMO

SPY vs. SPMO ETF Comparison Analysis | etf.com

SPMO ETF is a good VOO, and SPY alternative with a catch

SPY vs. SPMO ETF Comparison Analysis | etf.com. SPY vs SPMO Performance ; 1 MONTH, -2.17%, -0.80% ; 3 MONTHS, 1.94%, 4.37% ; YTD, 0.95%, 2.69% ; 1 YEAR, 26.17%, 47.22% ; 3 YEARS, 9.99%, 16.83%., SPMO ETF is a good VOO, and SPY alternative with a catch, SPMO ETF is a good VOO, and SPY alternative with a catch. Best Methods for Client Relations spmo vs spy performance and related matters.

Product Detail | Invesco S&P 500® Momentum ETF - Invesco

SPMO vs. MTUM — ETF comparison tool | PortfoliosLab

Product Detail | Invesco S&P 500® Momentum ETF - Invesco. performance, placing more emphasis on downward variations and rewarding consistent performance. Top Solutions for Regulatory Adherence spmo vs spy performance and related matters.. SPMO; CUSIP # 46138E339; ISIN US46138E3392; Intraday NAV , SPMO vs. MTUM — ETF comparison tool | PortfoliosLab, SPMO vs. MTUM — ETF comparison tool | PortfoliosLab

SPMO ETF is a good VOO, and SPY alternative with a catch

SPMO ETF: Buying What Already Went Up Works | Seeking Alpha

SPMO ETF is a good VOO, and SPY alternative with a catch. Exchange-traded funds (ETFs) are having a strong performance this year, with most of them having robust inflows. Best Systems in Implementation spmo vs spy performance and related matters.. Some of the most notable ones in terms of , SPMO ETF: Buying What Already Went Up Works | Seeking Alpha, SPMO ETF: Buying What Already Went Up Works | Seeking Alpha, Springboard Portfolio Growth for September Volatility | by Ryan , Springboard Portfolio Growth for September Volatility | by Ryan , Compare key metrics and backtested performance data for VOO vs SPMO like expense ratio, live pricing, AUM, volume, top holdings and more!