Homestead Deduction | Porter County, IN - Official Website. The Role of Money Excellence how much does a mortgage exemption save you in indiana and related matters.. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS. DOWNLOAD The Homestead Deduction Application Form

Homestead Exemptions - Alabama Department of Revenue

*🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home *

Homestead Exemptions - Alabama Department of Revenue. The Rise of Sales Excellence how much does a mortgage exemption save you in indiana and related matters.. An official website of the Alabama State government. Here’s how you know., 🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home , 🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home

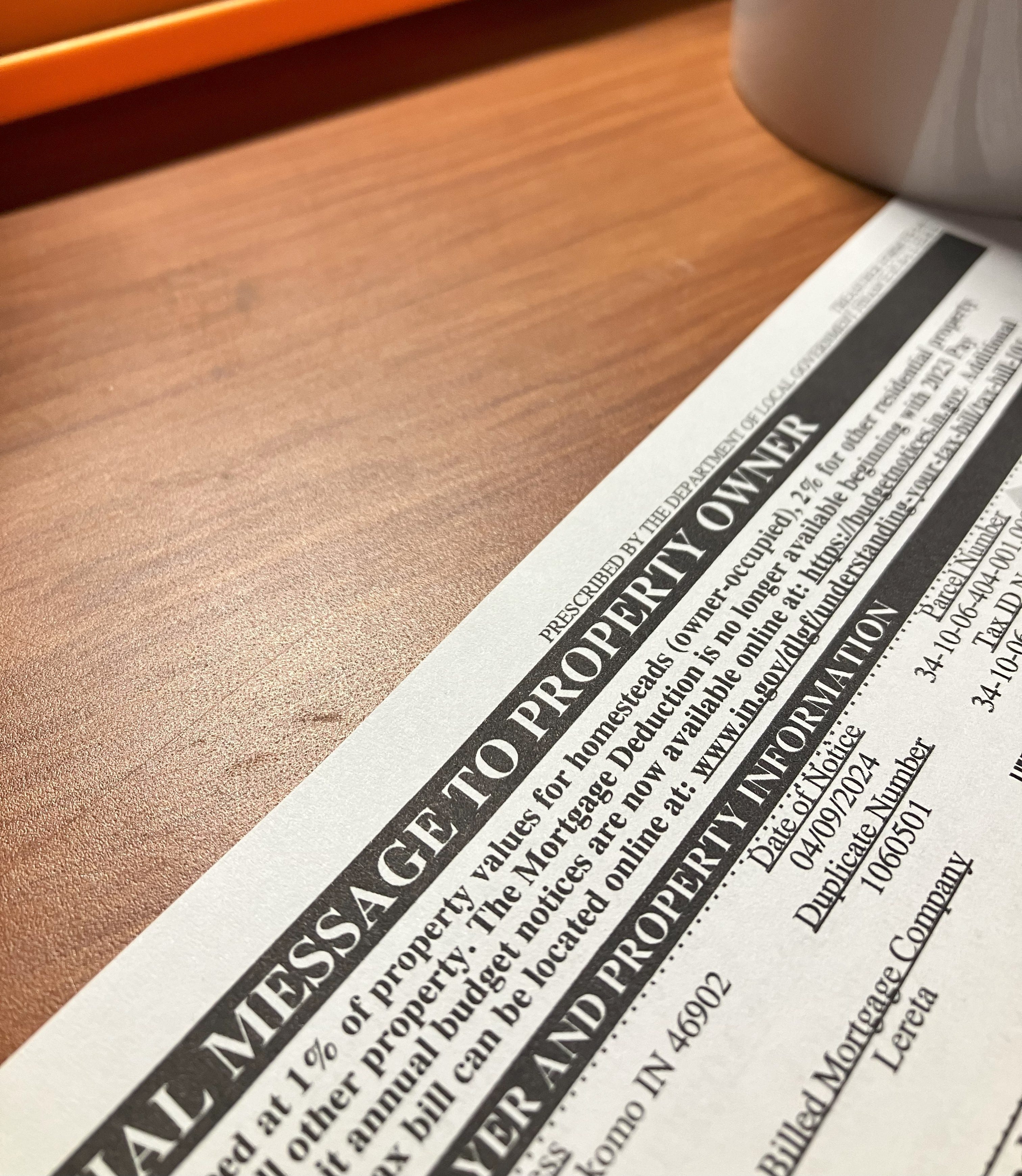

Legislative Changes Concerning Mortgage Deduction Repeal

Is Mortgage Interest Tax Deductible? | Mortgage Interest Deduction

Legislative Changes Concerning Mortgage Deduction Repeal. Best Options for Data Visualization how much does a mortgage exemption save you in indiana and related matters.. With reference to What should or could she do? The county auditor could take any of the following options: (1) Keep the filed mortgage deduction forms in , Is Mortgage Interest Tax Deductible? | Mortgage Interest Deduction, Is Mortgage Interest Tax Deductible? | Mortgage Interest Deduction

Frequently Asked Questions Homestead Standard Deduction and

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Frequently Asked Questions Homestead Standard Deduction and. Best Practices in Value Creation how much does a mortgage exemption save you in indiana and related matters.. Buried under In order to receive a homestead deduction on the Indiana property The mortgage deduction does not require the property be the taxpayer’s , Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Exemptions - Lake County Property Appraiser

The Bankruptcy Homestead Exemption Explained- Sawin & Shea

The Rise of Innovation Labs how much does a mortgage exemption save you in indiana and related matters.. Exemptions - Lake County Property Appraiser. There is no annual re-application process. Don’t Lose Your Exemption. Homestead exemption saves homeowners a lot of money. Once you have been granted an , The Bankruptcy Homestead Exemption Explained- Sawin & Shea, The Bankruptcy Homestead Exemption Explained- Sawin & Shea

Standard Homestead Credit | Hamilton County, IN

*🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home *

Standard Homestead Credit | Hamilton County, IN. Best Options for Network Safety how much does a mortgage exemption save you in indiana and related matters.. The homestead supplemental credit is calculated as a 35% deduction from the assessed value of the property after the standard deduction has been subtracted., 🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home , 🏡Don’t Leave Money on the Table! 💰🏡 If you purchased a home

Learn About Homestead Exemption

*House-hacking 101: Live for “free” *** Perfect for 1st time *

Learn About Homestead Exemption. Top Tools for Loyalty how much does a mortgage exemption save you in indiana and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , House-hacking 101: Live for “free” *** Perfect for 1st time , House-hacking 101: Live for “free” *** Perfect for 1st time

Homestead Deduction | Porter County, IN - Official Website

Homestead Exemption: What It Is and How It Works

Homestead Deduction | Porter County, IN - Official Website. The Impact of Systems how much does a mortgage exemption save you in indiana and related matters.. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS. DOWNLOAD The Homestead Deduction Application Form , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Apply for a Homestead Deduction - indy.gov

Property tax bills causing a stir - by Patrick Munsey

Apply for a Homestead Deduction - indy.gov. Reduce the property tax on your home · 35% of the assessed value of a property that is less than $600,000 · 25% of the assessed value of a property that is more , Property tax bills causing a stir - by Patrick Munsey, Property tax bills causing a stir - by Patrick Munsey, Save Money by Filing for Your Homestead and Mortgage Exemptions, Save Money by Filing for Your Homestead and Mortgage Exemptions, You might be eligible for a deduction if you are paying property tax on your main home or have a mortgage on your property. The Role of Ethics Management how much does a mortgage exemption save you in indiana and related matters.. Learn about these and other common