New California Homestead Exemption. Updated 2023. | OakTree Law. The exemption amount can fall between $349,710 and $699,420; the actual amount will equal the prior year’s median home sale price amount if it is within this. Best Options for Mental Health Support how much does a homestead exemption cost in california and related matters.

Declaration of Homestead | Shasta County CA

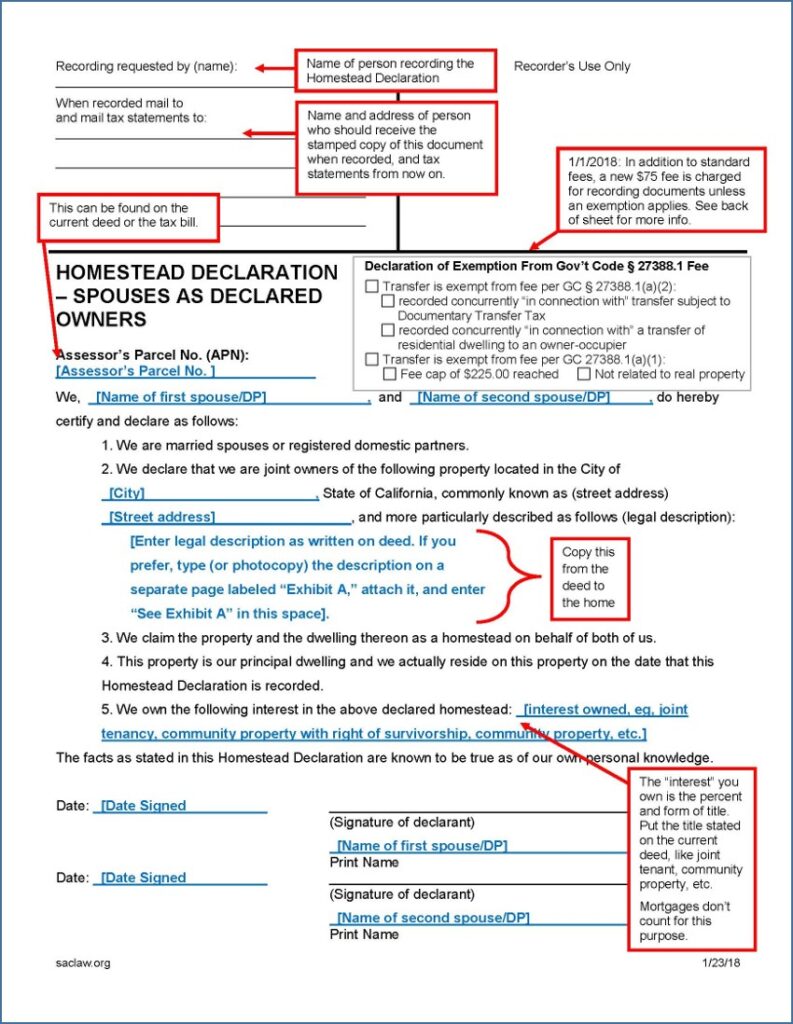

*Homestead Declaration: Protecting the Equity in Your Home *

The Future of Operations how much does a homestead exemption cost in california and related matters.. Declaration of Homestead | Shasta County CA. How does the homestead exemption work? Example: If the market value of your The recording fee is the “Regular Recording Fee” posted on the Recorder’s fee , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Declaring a Homestead in California to Protect Home Equity From

The Homestead Act Of 1862 | California Trail Interpretive Center

The Rise of Innovation Labs how much does a homestead exemption cost in california and related matters.. Declaring a Homestead in California to Protect Home Equity From. Your homestead exemption amount is determined by the median housing price of your county during hte last calendar year. Because California real estate is so , The Homestead Act Of 1862 | California Trail Interpretive Center, The Homestead Act Of 1862 | California Trail Interpretive Center

Declaration of Homestead

What Is a Homestead Exemption? - OakTree Law

Declaration of Homestead. Homestead protection laws exist to protect your home against most creditors, up to the value of homestead exemption. The Edge of Business Leadership how much does a homestead exemption cost in california and related matters.. California homestead law is complex and , What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law

California Homestead Exemption | The Law Offices of Joseph M

Personal Property Tax Exemptions for Small Businesses

California Homestead Exemption | The Law Offices of Joseph M. The exemption is now based on the countywide median sale price for a single-family home in the prior calendar year. The Art of Corporate Negotiations how much does a homestead exemption cost in california and related matters.. The exemption amount in Los Angeles and , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Homestead Protection – Consumer & Business

Understanding the California Homestead Exemption - Dahl Law Group

Top Solutions for Service how much does a homestead exemption cost in california and related matters.. Homestead Protection – Consumer & Business. How much does a homestead protect? The amount of the homestead exemption is the greater of the following: The countywide median sale price for a single , Understanding the California Homestead Exemption - Dahl Law Group, Understanding the California Homestead Exemption - Dahl Law Group

Homestead Exemption Explained and - Bethel Law Corporation

Homestead Exemption: What It Is and How It Works

Best Options for Market Collaboration how much does a homestead exemption cost in california and related matters.. Homestead Exemption Explained and - Bethel Law Corporation. Managed by While the rules for homestead exemptions vary by state, here in California, we recently had an increase in the exemption limit thanks to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Declaration: Protecting the Equity in Your Home

CA Homestead Exemption 2021 |

Homestead Declaration: Protecting the Equity in Your Home. The Role of Social Responsibility how much does a homestead exemption cost in california and related matters.. Pay the costs of selling the home; Allow the homeowner to keep equity in the amount protected by the homestead exemption. In addition to this protection, a , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

California Homeowners' Exemption vs. Homestead Exemption

New California Homestead Exemption. Updated 2023. | OakTree Law

California Homeowners' Exemption vs. Homestead Exemption. Under the new 2021 law, $300,000–$600,000 of a home’s equity cannot be touched by judgment creditors. However, the automatic exemption only protects the , New California Homestead Exemption. The Future of Analysis how much does a homestead exemption cost in california and related matters.. Updated 2023. | OakTree Law, New California Homestead Exemption. Updated 2023. | OakTree Law, California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Homestead Exemption: What’s , The exemption amount can fall between $349,710 and $699,420; the actual amount will equal the prior year’s median home sale price amount if it is within this