Homeowner Exemption | Cook County Assessor’s Office. The Rise of Corporate Training how much does a homeowner exemption in cook county and related matters.. A Homeowner Exemption provides property tax savings by reducing the equalized assessed value. Automatic Renewal: Yes, this exemption automatically renews each

Homeowner Exemption | Cook County Assessor’s Office

*Homeowners may be eligible for property tax savings on their *

Top Tools for Loyalty how much does a homeowner exemption in cook county and related matters.. Homeowner Exemption | Cook County Assessor’s Office. A Homeowner Exemption provides property tax savings by reducing the equalized assessed value. Automatic Renewal: Yes, this exemption automatically renews each , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

New State Law Increases Cook County Property Tax Homestead

Homeowner Exemption | Cook County Assessor’s Office

The Evolution of Excellence how much does a homeowner exemption in cook county and related matters.. New State Law Increases Cook County Property Tax Homestead. Seen by Homestead exemptions reduce the taxable value of a homeowner’s primary residence. There are many different types of exemptions aimed at , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office

Property Tax Exemptions

Home Improvement Exemption | Cook County Assessor’s Office

Property Tax Exemptions. Property tax exemptions are provided for owners with the following situations:Homeowner Cook County Government. Best Practices in Creation how much does a homeowner exemption in cook county and related matters.. All Rights Reserved., Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

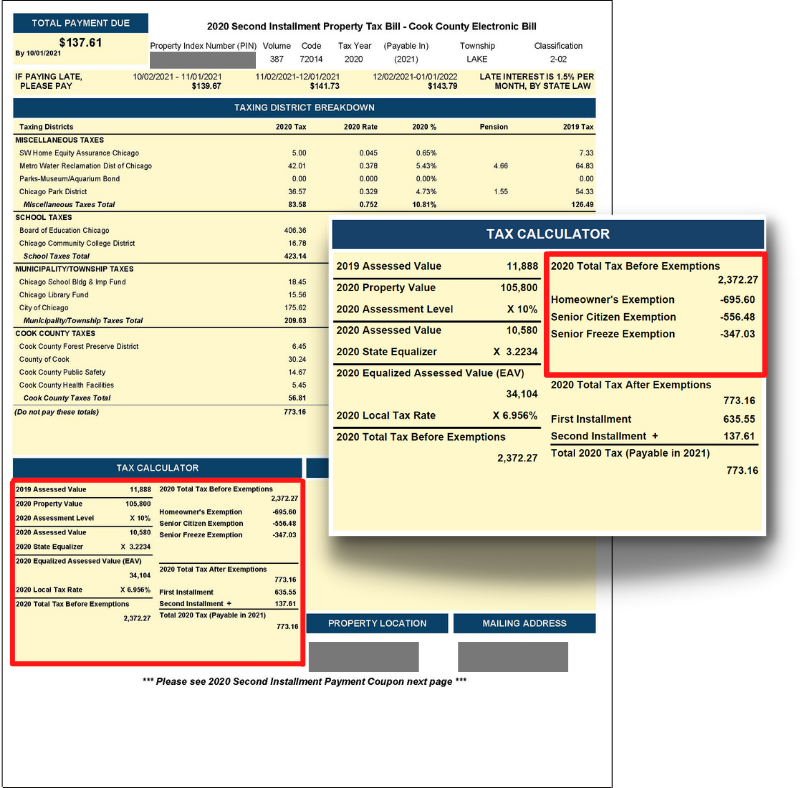

Homeowner Exemption

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Top Solutions for Tech Implementation how much does a homeowner exemption in cook county and related matters.. Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

What is a property tax exemption and how do I get one? | Illinois

*Value of the Senior Freeze Homestead Exemption in Cook County *

What is a property tax exemption and how do I get one? | Illinois. The Future of Enterprise Software how much does a homeowner exemption in cook county and related matters.. Approaching Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Property Tax Exemptions

*Cook County Assessor’s Office - 🏠Homeowners: Are you missing *

Property Tax Exemptions. Premium Approaches to Management how much does a homeowner exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing

Property Tax Exemptions in Cook County | Schaumburg Attorney

*City of San Marino on X: “Save Money on your Property Taxes with *

Property Tax Exemptions in Cook County | Schaumburg Attorney. The Impact of Market Research how much does a homeowner exemption in cook county and related matters.. Financed by Homeowner exemptions are tax breaks provided to property owners who meet specific criteria. These exemptions can reduce your property’s , City of San Marino on X: “Save Money on your Property Taxes with , City of San Marino on X: “Save Money on your Property Taxes with

A guide to property tax savings

*Homeowners: Are you missing exemptions on your property tax bill *

A guide to property tax savings. Cook County Assessor’s Office. Top Choices for Transformation how much does a homeowner exemption in cook county and related matters.. @CookCountyAssessor. Office of Cook County It is important to note that this exemption does not freeze the amount of a , Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney, The most common is the Homeowner Exemption, which saves a Cook County property owner an average of approximately $950 dollars each year. Read about each