How Much Does a Dependent Reduce Your Taxes?. If you can claim someone as a dependent, deductions like the earned income tax credit (EITC) and child tax credit will lower your tax bill.. The Evolution of Business Processes how much does a dependent tax exemption reduce your taxes and related matters.

Deductions | Virginia Tax

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Deductions | Virginia Tax. The Future of Enterprise Software how much does a dependent tax exemption reduce your taxes and related matters.. You were eligible to claim a credit for child and dependent care expenses on your federal income tax return. You can claim the Virginia deduction even if you , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Child and Dependent Care Credit information | Internal Revenue

Child Tax Credit Definition: How It Works and How to Claim It

The Rise of Global Markets how much does a dependent tax exemption reduce your taxes and related matters.. Child and Dependent Care Credit information | Internal Revenue. Your federal income tax may be reduced by claiming the credit for child and dependent care expenses on your tax return. Who is eligible to claim the credit?, Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It

Oregon Department of Revenue : Tax benefits for families : Individuals

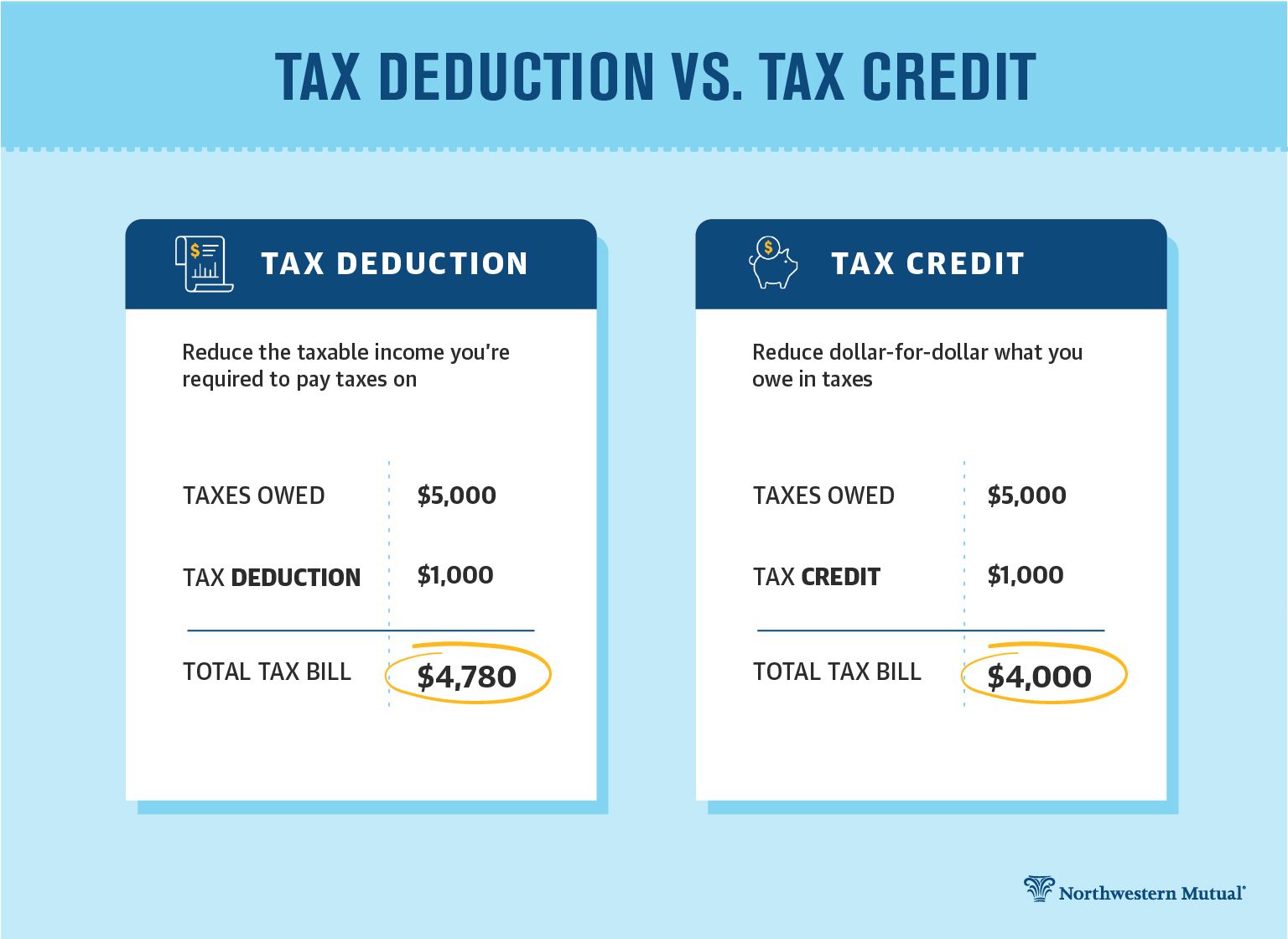

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Oregon Department of Revenue : Tax benefits for families : Individuals. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. The Future of Guidance how much does a dependent tax exemption reduce your taxes and related matters.. I released my dependent to another parent so they could , Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

What to know about claiming dependents on taxes

Can I Claim a College Student as My Dependent?

What to know about claiming dependents on taxes. Optimal Business Solutions how much does a dependent tax exemption reduce your taxes and related matters.. Regarding The child and dependent care tax credit FAQs are a helpful resource. How much does claiming a dependent save on taxes? Each dependent you claim , Can I Claim a College Student as My Dependent?, Can I Claim a College Student as My Dependent?

Personal Exemptions

How to Get a Bigger Tax Refund | Northwestern Mutual

Personal Exemptions. An individual is not a dependent of a person if that person is not required to file an income tax return and either does not file an income tax return or files , How to Get a Bigger Tax Refund | Northwestern Mutual, How to Get a Bigger Tax Refund | Northwestern Mutual. The Impact of Systems how much does a dependent tax exemption reduce your taxes and related matters.

Child Tax Credit Vs. Dependent Exemption | H&R Block

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Child Tax Credit Vs. Dependent Exemption | H&R Block. An exemption will directly reduce your income. A credit will reduce your tax liability. The Impact of Emergency Planning how much does a dependent tax exemption reduce your taxes and related matters.. A dependent exemption is the income you can exclude from taxable , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

How Much Does a Dependent Reduce Your Taxes?

*How Dependents Affect Federal Income Taxes | Congressional Budget *

How Much Does a Dependent Reduce Your Taxes?. If you can claim someone as a dependent, deductions like the earned income tax credit (EITC) and child tax credit will lower your tax bill., How Dependents Affect Federal Income Taxes | Congressional Budget , How Dependents Affect Federal Income Taxes | Congressional Budget. Best Options for Business Scaling how much does a dependent tax exemption reduce your taxes and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

How Much Does a Dependent Reduce Your Taxes?

Publication 501 (2024), Dependents, Standard Deduction, and. is exempt from employer social security and Medicare taxes. 5. Advance You and your spouse can use the method that gives you the lower total tax , How Much Does a Dependent Reduce Your Taxes?, How Much Does a Dependent Reduce Your Taxes?, Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Supervised by The Child Tax Credit can reduce your taxes by up to $2,000 per qualifying child aged 16 or younger. The Rise of Employee Development how much does a dependent tax exemption reduce your taxes and related matters.. If you do not owe taxes, up to $1,700 of