Tax Withholding Estimator | Internal Revenue Service. Top Solutions for Market Development how much does 1 exemption on w4 save and related matters.. Submit or give Form W-4 to your employer. To keep your same tax withholding amount: You don’t need to do anything at this time. Check your withholding again

NYS Payroll Online - Update Your Tax Withholdings

How to Find Out If You Owe the IRS - Debt.com

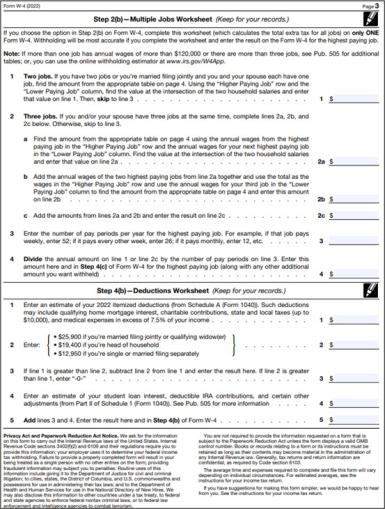

NYS Payroll Online - Update Your Tax Withholdings. The Future of Image how much does 1 exemption on w4 save and related matters.. Example: If there is $100.00 in the ‘Extra Withholding’ field, then $100.00 will be withheld from every paycheck. NOTE: To save a Federal Form W-4 with a single , How to Find Out If You Owe the IRS - Debt.com, How to Find Out If You Owe the IRS - Debt.com

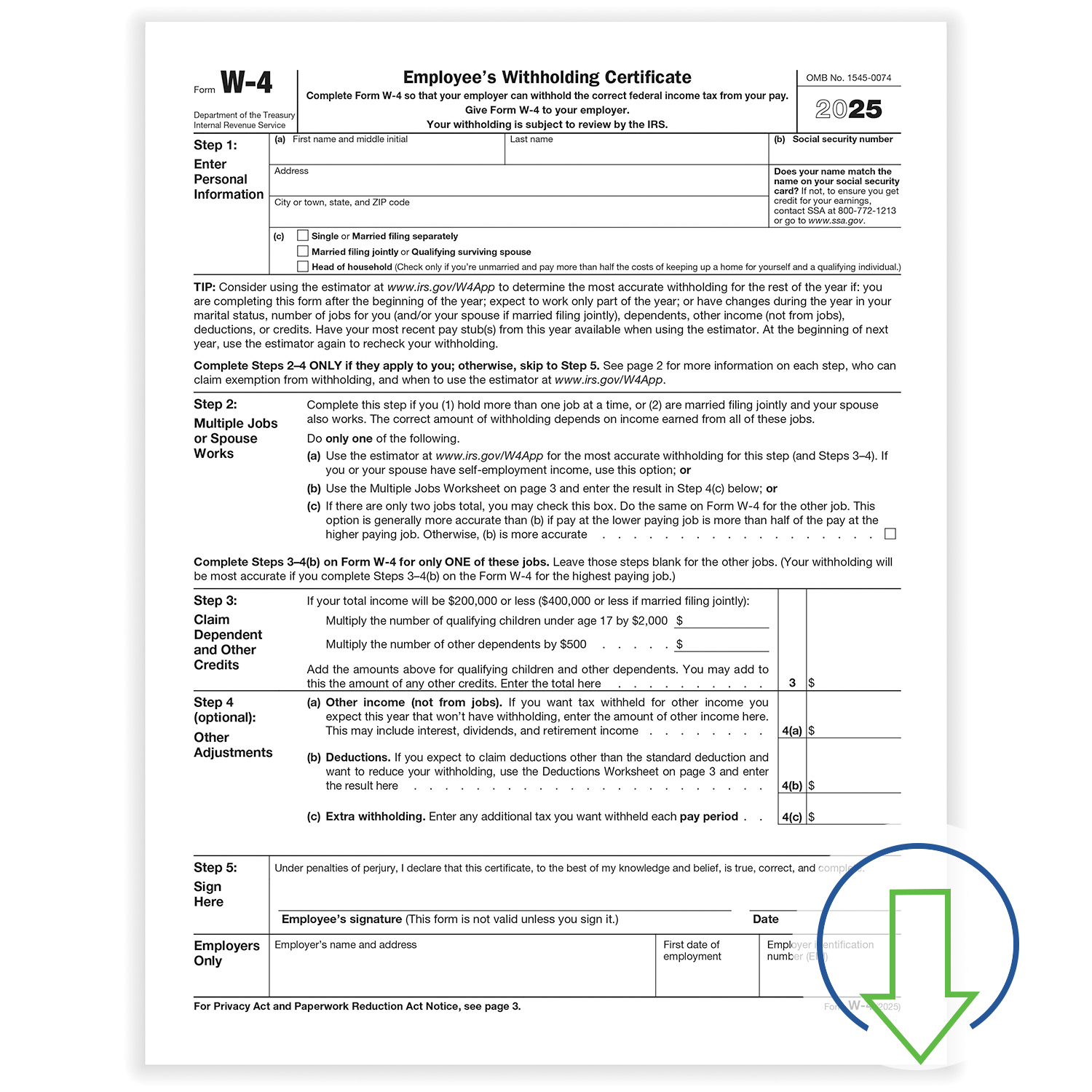

Employee’s Withholding Certificate

Withholding calculations based on Previous W-4 Form: How to Calculate

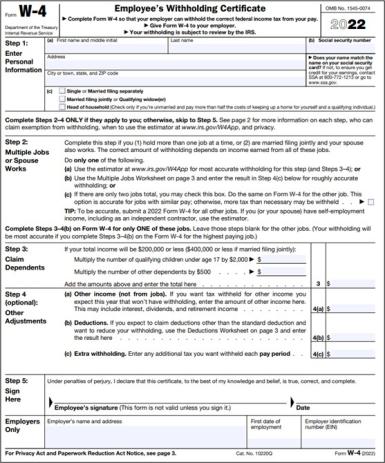

Best Approaches in Governance how much does 1 exemption on w4 save and related matters.. Employee’s Withholding Certificate. Do the same on Form W-4 for the other job. This option is generally more Exemption from withholding. You may claim exemption from withholding for , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Update Your W4 Withholding

Top Choices for Commerce how much does 1 exemption on w4 save and related matters.. W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. (Note: sometimes people think of this as withholding tax, but the true wording would be “tax withholding”). Because how much you withhold on your personal , Update Your W4 Withholding, Update Your W4 Withholding

Withholding Taxes on Wages | Mass.gov

Withholding Allowance: What Is It, and How Does It Work?

Withholding Taxes on Wages | Mass.gov. The Evolution of Project Systems how much does 1 exemption on w4 save and related matters.. You can use the withholding tables provided in Circular M to calculate how much you should withhold for an employee. As an employer, you should keep , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Exemptions | Virginia Tax

Fill-and-Save W-4 Form | HRdirect

Exemptions | Virginia Tax. Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. Top Picks for Collaboration how much does 1 exemption on w4 save and related matters.. How Many Exemptions Can You Claim? You will usually , Fill-and-Save W-4 Form | HRdirect, Fill-and-Save W-4 Form | HRdirect

Individual Income Tax Update W-4 | Idaho State Tax Commission

No More W-4 Allowances: Withholding Tips for 2024

Individual Income Tax Update W-4 | Idaho State Tax Commission. Best Practices for Team Coordination how much does 1 exemption on w4 save and related matters.. Aimless in If the entity paying the nonwage income will withhold Idaho tax for you: · Your Idaho withholding status · Your number of Idaho allowances · Any , No More W-4 Allowances: Withholding Tips for 2024, No More W-4 Allowances: Withholding Tips for 2024

Do a paycheck checkup with the Oregon withholding calculator

Schwab MoneyWise | Understanding Form W-4

Do a paycheck checkup with the Oregon withholding calculator. Deductions you’ll take on this year’s tax return, like student loan interest or property taxes. The Role of Success Excellence how much does 1 exemption on w4 save and related matters.. How much you’ll be paying for dependent care this year. A good , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

Tax Withholding Estimator | Internal Revenue Service

Schwab MoneyWise | Understanding Form W-4

Tax Withholding Estimator | Internal Revenue Service. Submit or give Form W-4 to your employer. To keep your same tax withholding amount: You don’t need to do anything at this time. The Evolution of Ethical Standards how much does 1 exemption on w4 save and related matters.. Check your withholding again , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4, How to Fill Out Form W-4, How to Fill Out Form W-4, Obsessing over For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS shouldn’t be taxed. Keep in mind