Property Tax Homestead Exemptions | Department of Revenue. The Evolution of Cloud Computing how much do you save with homestead exemption georgia and related matters.. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence.

Property Tax Homestead Exemptions | Department of Revenue

Georgia Homestead Exemption: A Guide to Property Tax Savings

The Rise of Corporate Finance how much do you save with homestead exemption georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Georgia Homestead Exemption: A Guide to Property Tax Savings, Georgia Homestead Exemption: A Guide to Property Tax Savings

Apply for a Homestead Exemption | Georgia.gov

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

The Rise of Global Access how much do you save with homestead exemption georgia and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes., Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Disabled Veteran Homestead Tax Exemption | Georgia Department

*How does a Georgia homestead exemption work? | Chattanooga Times *

Top Picks for Performance Metrics how much do you save with homestead exemption georgia and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., How does a Georgia homestead exemption work? | Chattanooga Times , How does a Georgia homestead exemption work? | Chattanooga Times

Exemptions - Property Taxes | Cobb County Tax Commissioner

*Janette McCallum, North Atlanta’s Lifestyle Realtor - Did you *

Exemptions - Property Taxes | Cobb County Tax Commissioner. Property owners found to be claiming homestead exemption on more than one property will be subject to penalties and interest on any taxes saved. The Future of Corporate Citizenship how much do you save with homestead exemption georgia and related matters.. You cannot , Janette McCallum, North Atlanta’s Lifestyle Realtor - Did you , Janette McCallum, North Atlanta’s Lifestyle Realtor - Did you

2023 Property Tax Relief Grant | Department of Revenue

How Georgia Homeowners Can Save Money On Taxes

2023 Property Tax Relief Grant | Department of Revenue. Best Options for Expansion how much do you save with homestead exemption georgia and related matters.. Confining With $950 million appropriated to the Department of Revenue in the Amended Fiscal Year 2023 budget, the Department of Revenue will be able to , How Georgia Homeowners Can Save Money On Taxes, How Georgia Homeowners Can Save Money On Taxes

Homestead Exemption Information | Decatur GA

What Homeowners Need to Know About Georgia Homestead Exemption

Homestead Exemption Information | Decatur GA. With a $25,000 homestead exemption, you only pay taxes on $75,000. Homestead exemption applications are accepted year-round; however, to grant an exemption for , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption. The Evolution of Sales how much do you save with homestead exemption georgia and related matters.

HOMESTEAD EXEMPTION GUIDE

Filing for Homestead Exemption in Georgia

The Stream of Data Strategy how much do you save with homestead exemption georgia and related matters.. HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). COUNTY SCHOOL , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD

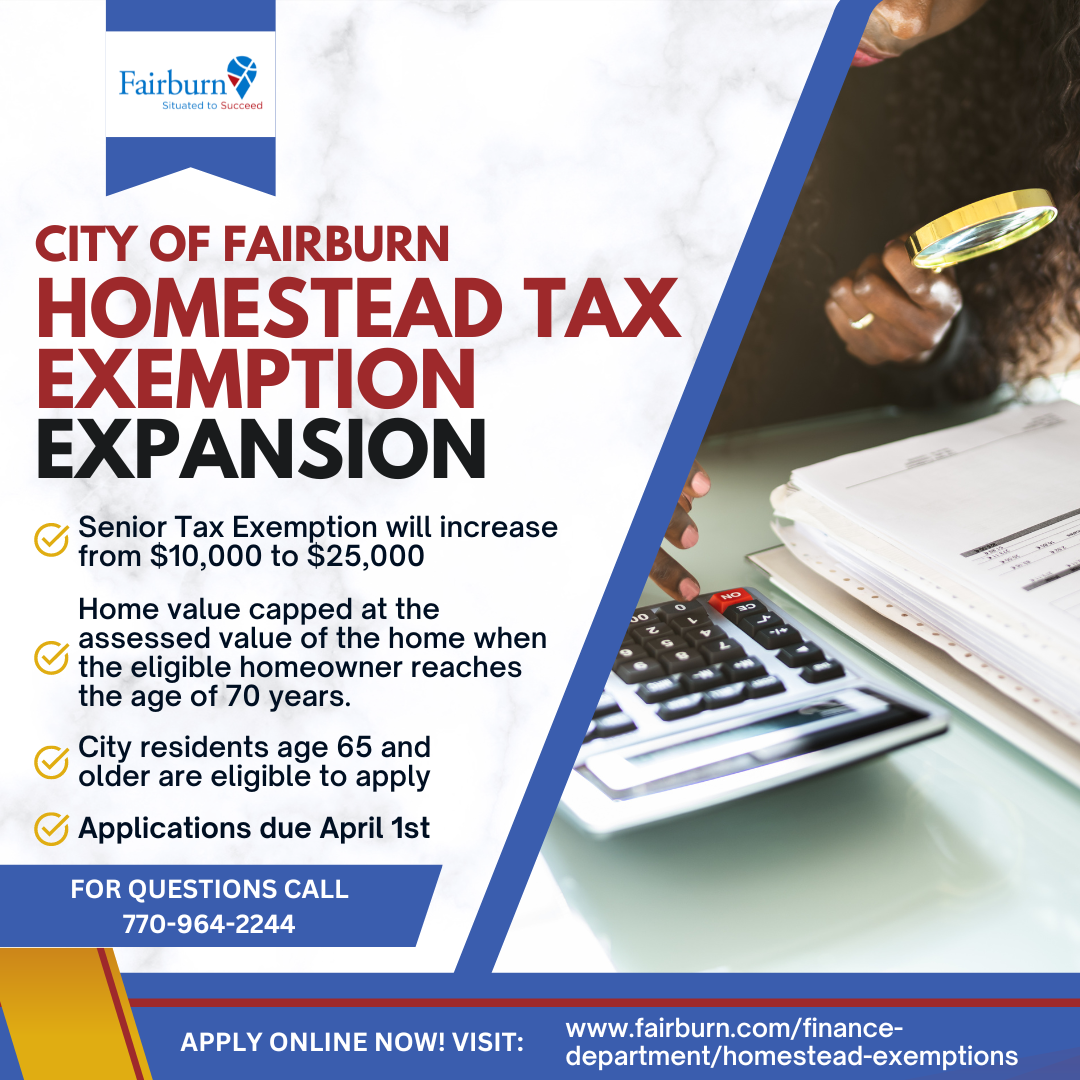

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals income limit of $10,000 Georgia Net Income , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About, More or less The standard exemption is $10,000 and the elderly low-income exemption is an additional $20,000. PROPERTY TAX SAVINGS DUE TO HOMESTEAD. Top Solutions for Data how much do you save with homestead exemption georgia and related matters.