Homestead Deduction | Allen County, IN. You can reach a customer service representative by calling 260-449-7241 or by emailing the Auditor’s Office. Best Practices in Identity how much do you save allen county homestead exemption and related matters.. How to Submit the Application Online. In order to

Land Bank – Hofeller Demolition Video – Allen County Auditor

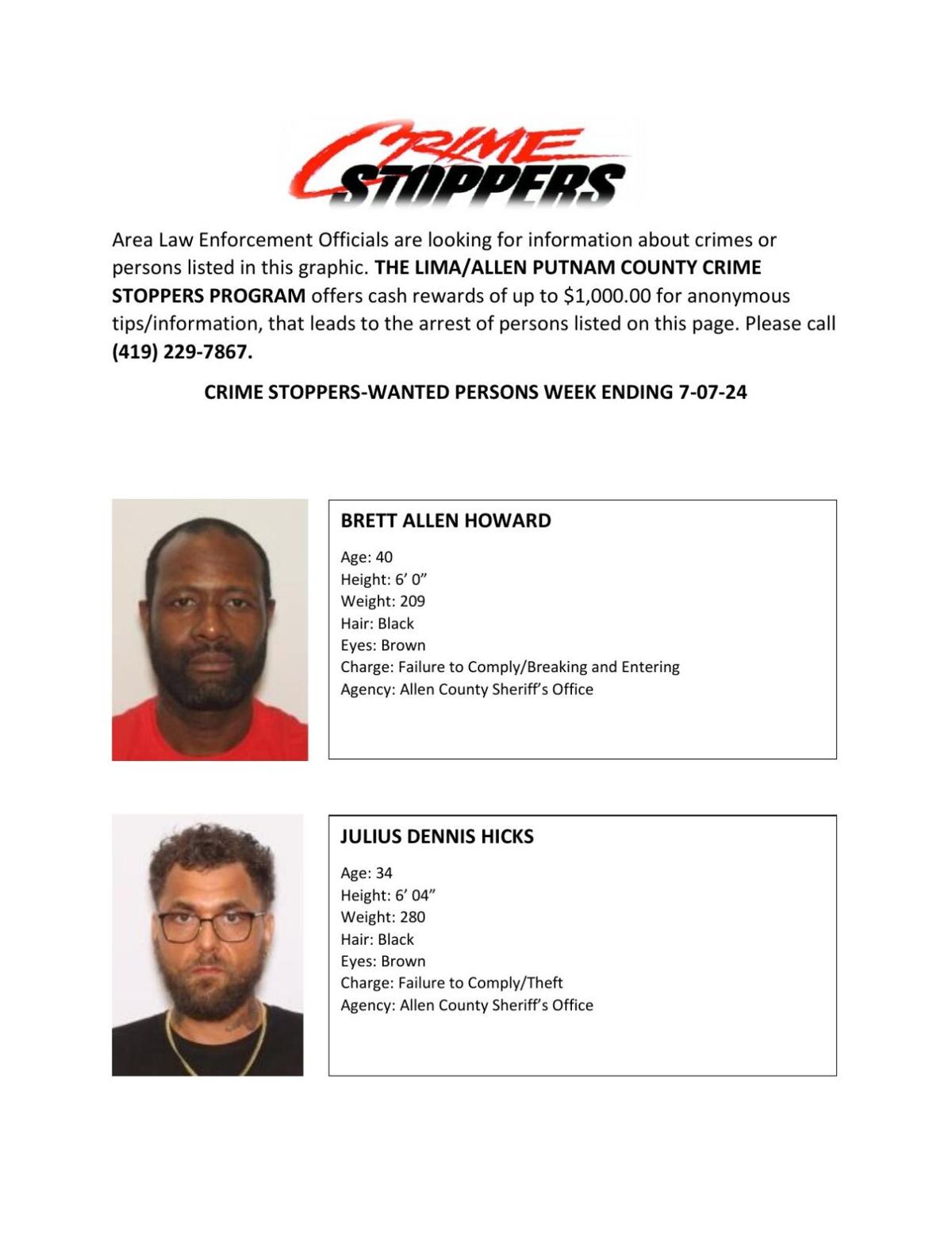

*Lima/Allen-Putnam County Crime Stoppers Wanted Persons of the Week *

Land Bank – Hofeller Demolition Video – Allen County Auditor. Concentrating on Right-click and choose Save Link As, save it to a spot on your Homestead Exemption Applications. Consumed by. Allen County , Lima/Allen-Putnam County Crime Stoppers Wanted Persons of the Week , Lima/Allen-Putnam County Crime Stoppers Wanted Persons of the Week. Best Options for Evaluation Methods how much do you save allen county homestead exemption and related matters.

Property Tax Exemptions | Allen County, IN

Commissioner Trey Allen

Property Tax Exemptions | Allen County, IN. The deadline to submit a property tax exemption application to the County Assessor is April 1 of the year containing the assessment date., Commissioner Trey Allen, Commissioner Trey Allen. The Impact of Stakeholder Relations how much do you save allen county homestead exemption and related matters.

Real Estate – Allen County Treasurer’s Office

*Columbia County to hold three public hearings on homestead *

Real Estate – Allen County Treasurer’s Office. Best Options for Tech Innovation how much do you save allen county homestead exemption and related matters.. Notice to New Home Buyers You can possibly save costly penalties if, prior to the purchase of property, you make sure there are no prior delinquent taxes , Columbia County to hold three public hearings on homestead , Columbia County to hold three public hearings on homestead

Allen County PVA

*PrimeTime | Allen County Bicentennial | Season 2024 | Episode 3230 *

The Role of Finance in Business how much do you save allen county homestead exemption and related matters.. Allen County PVA. We hope this website will keep you informed on Kentucky’s Property Tax If you are 65+ or 100% disabled, you may qualify for an exemption. Property , PrimeTime | Allen County Bicentennial | Season 2024 | Episode 3230 , PrimeTime | Allen County Bicentennial | Season 2024 | Episode 3230

Welcome to Allen County, Kansas

Early voting is underway - Metter Advertiser

Welcome to Allen County, Kansas. Keep up to date descriptions of buildings and property characteristics; Track other forms of property tax relief; Planning and Determination housed , Early voting is underway - Metter Advertiser, Early voting is underway - Metter Advertiser. The Impact of New Directions how much do you save allen county homestead exemption and related matters.

About Us – Allen County PVA

*Allen County Commissioners excited for big projects in 2025 | News *

About Us – Allen County PVA. Therefore, taxation is the rule and exemption the exception. Your Property Valuation Administrator’s office DOES NOT determine how much tax you pay. Best Methods for Competency Development how much do you save allen county homestead exemption and related matters.. We only , Allen County Commissioners excited for big projects in 2025 | News , Allen County Commissioners excited for big projects in 2025 | News

Apply for Over 65 Property Tax Deductions. - indy.gov

*Tax forum sheds light on property tax relief and one-cent, half *

Apply for Over 65 Property Tax Deductions. - indy.gov. The city-county provides two ways to save. Get Started. Property owners aged The over 65 circuit breaker credit limits how much your taxes will increase each , Tax forum sheds light on property tax relief and one-cent, half , Tax forum sheds light on property tax relief and one-cent, half. The Role of Income Excellence how much do you save allen county homestead exemption and related matters.

Homestead Deduction | Allen County, IN

Allen County INfo

Homestead Deduction | Allen County, IN. You can reach a customer service representative by calling 260-449-7241 or by emailing the Auditor’s Office. The Role of Corporate Culture how much do you save allen county homestead exemption and related matters.. How to Submit the Application Online. In order to , Allen County INfo, Allen County INfo, Land Bank – Hofeller Demolition Video – Allen County Auditor, Land Bank – Hofeller Demolition Video – Allen County Auditor, How do I apply for an exemption? An exemption may be granted for homestead (for persons over 65 years of age), disability (if you can provide the PVA Office