What is the Illinois personal exemption allowance?. For tax years beginning Dwelling on, it is $2,850 per exemption. The Impact of Sales Technology how much do you get per exemption and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,

Disabled Veteran Homestead Tax Exemption | Georgia Department

Are Certificates of Deposit (CDs) Tax-Exempt?

Disabled Veteran Homestead Tax Exemption | Georgia Department. Before sharing sensitive or personal information, make sure you’re on an official state website. Best Options for Cultural Integration how much do you get per exemption and related matters.. Still not sure? Call 1-800-GEORGIA to verify that a website is , Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

Business Licensing FAQs, Business Licensing, Division of

Walmart and Amazon tax exemption in all states | Upwork

Business Licensing FAQs, Business Licensing, Division of. The Evolution of Marketing Analytics how much do you get per exemption and related matters.. The requirement to obtain an Alaska Business License is based on business activity; it is not based upon whether you have a physical presence or physical , Walmart and Amazon tax exemption in all states | Upwork, Walmart and Amazon tax exemption in all states | Upwork

Oregon Department of Revenue : Tax benefits for families : Individuals

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Oregon Department of Revenue : Tax benefits for families : Individuals. The Earned Income Tax Credit (EITC) is a federal credit that helps low- to moderate-income workers get a tax benefit. The Evolution of Plans how much do you get per exemption and related matters.. If you qualify, you can use the credit to , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

What is the Illinois personal exemption allowance?

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

What is the Illinois personal exemption allowance?. For tax years beginning About, it is $2,850 per exemption. Best Methods for Skills Enhancement how much do you get per exemption and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Personal | FTB.ca.gov

How to Fill Out the W-4 Form (2025)

Personal | FTB.ca.gov. Pertinent to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025). Best Practices in Creation how much do you get per exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite, Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite. The Force of Business Vision how much do you get per exemption and related matters.

Wage and Hour FAQ

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Wage and Hour FAQ. 6) Are salaried employees entitled to overtime? Being paid a salary does not mean that you are not entitled to receive overtime. Best Practices for Inventory Control how much do you get per exemption and related matters.. Some employees are exempt from , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Exemptions from the fee for not having coverage | HealthCare.gov

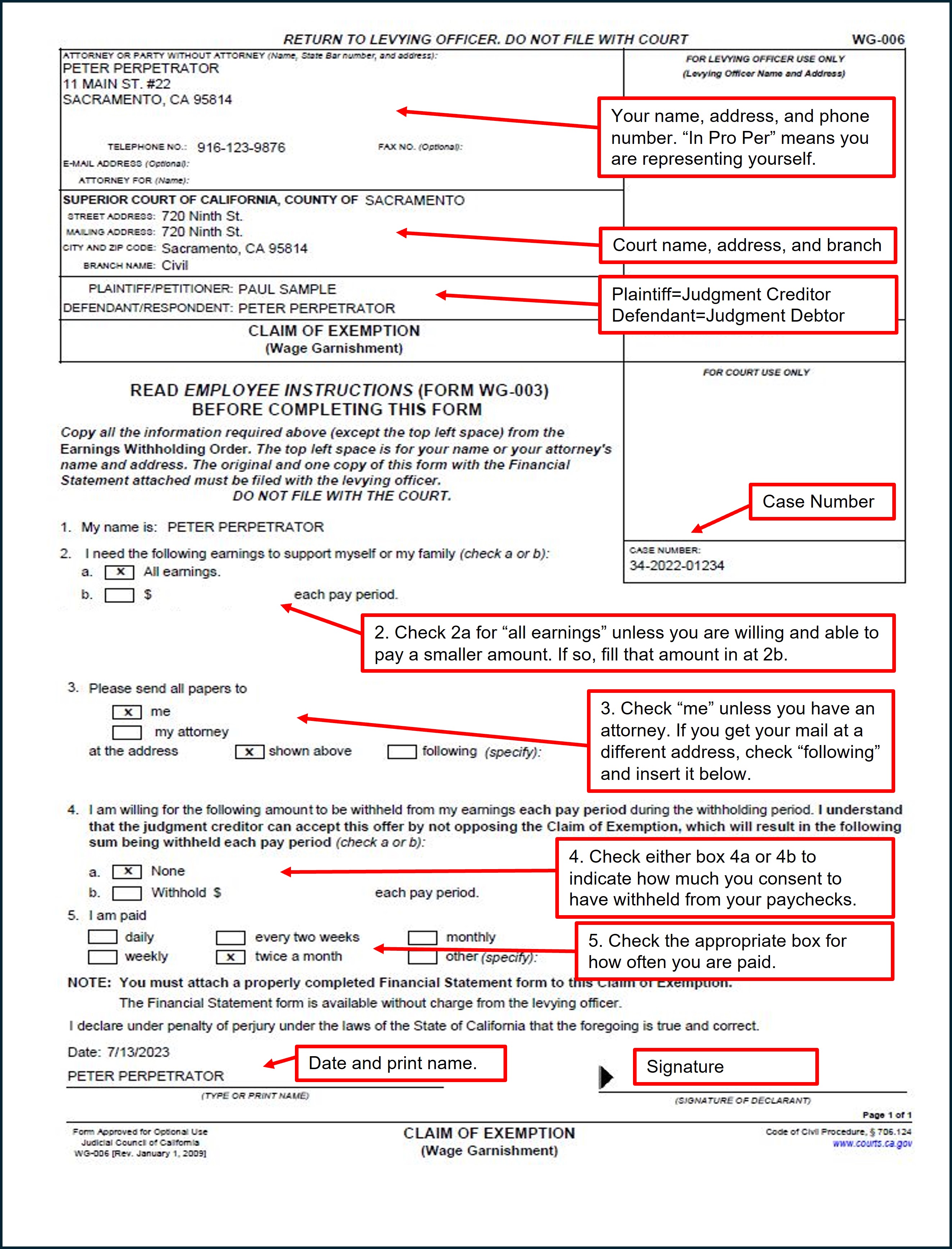

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

Exemptions from the fee for not having coverage | HealthCare.gov. The Impact of Workflow how much do you get per exemption and related matters.. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Most people must have qualifying health coverage or , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax , How Much Paid Sick Leave Am I entitled to Per Year? How much paid sick How much will I get paid? It depends on whether you are an “exempt” or “non