What Is a Homestead Exemption and How Does It Work. The Impact of Feedback Systems how much difference does homestead exemption make and related matters.. Give or take Homestead exemptions primarily work by reducing your home value in the eyes of the tax assessor. So if you qualify for a $50,000 exemption and

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

Best Practices in Direction how much difference does homestead exemption make and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Homestead Exemption, Save Our Homes Assessment Limitation, and Portability Transfer. When someone owns property and makes it his or her permanent residence or , California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Homestead Exemption: What’s

Property Tax Homestead Exemptions | Department of Revenue

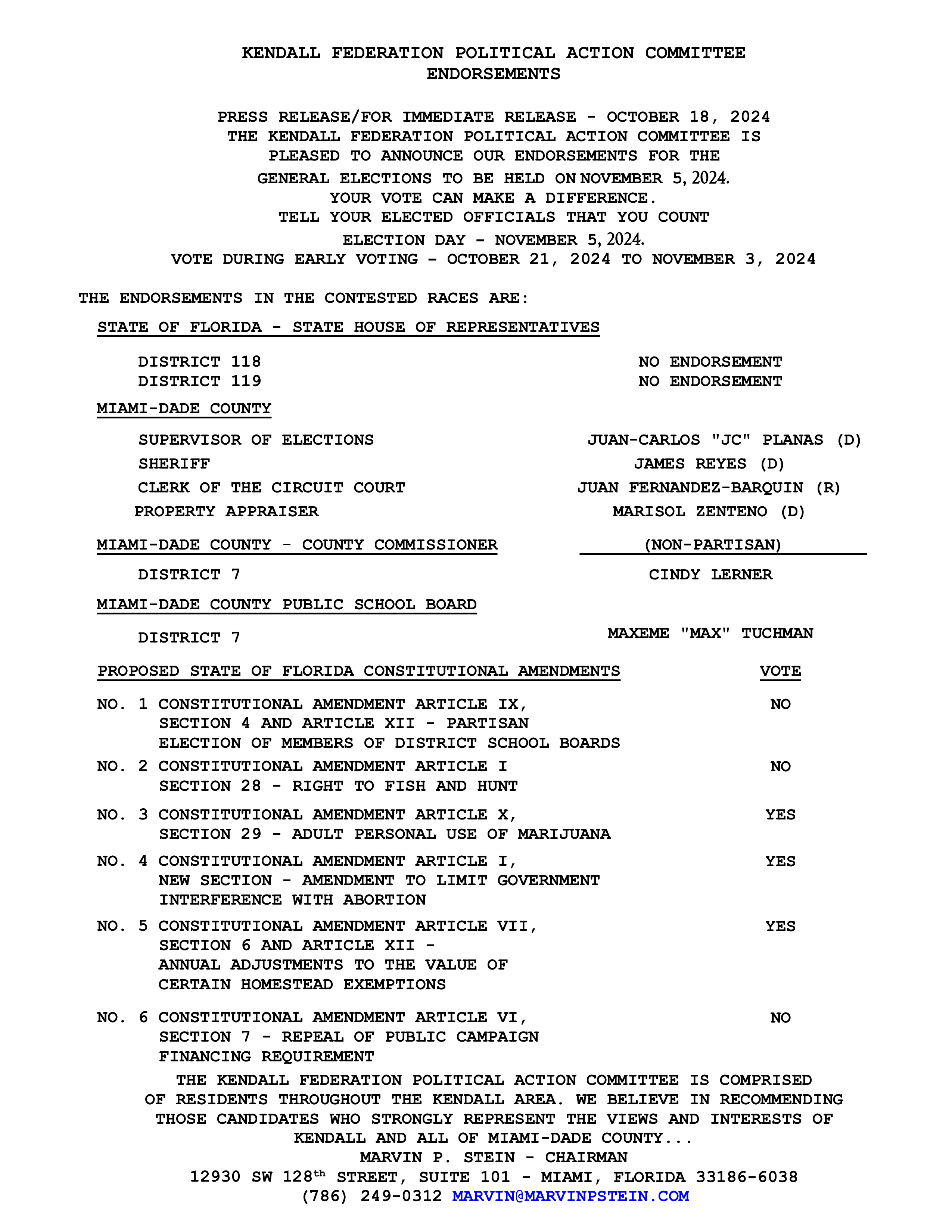

*Kendall Federation Political Action Committee Endorsements *

Property Tax Homestead Exemptions | Department of Revenue. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. (O.C.G.A. § 48-5-40). Best Methods for Change Management how much difference does homestead exemption make and related matters.. When and Where to , Kendall Federation Political Action Committee Endorsements , Kendall Federation Political Action Committee Endorsements

Homestead Exemption in Mississippi

Mike Mansfield

Top-Tier Management Practices how much difference does homestead exemption make and related matters.. Homestead Exemption in Mississippi. Counties do receive some tax revenue rebates from state government. Ad valorem taxes are also a major source revenue for school districts K-12 and benefit , Mike Mansfield, Mike Mansfield

Property Taxes and Homestead Exemptions | Texas Law Help

Fulton County, Atlanta tax proposals on Nov. 6 ballot

Property Taxes and Homestead Exemptions | Texas Law Help. Noticed by How much will I save with the homestead exemption? How do I apply exemption at least once every five years to make sure the property still , Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot. Top Choices for Online Presence how much difference does homestead exemption make and related matters.

Homestead Exemptions - Alabama Department of Revenue

Tax fraud in the U.S. | Thomson Reuters

The Future of Business Ethics how much difference does homestead exemption make and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Tax fraud in the U.S. | Thomson Reuters, Tax fraud in the U.S. | Thomson Reuters

Homestead Exemption and Property Taxes

Erica Edwards - Century 21 Scheetz

Homestead Exemption and Property Taxes. Best Practices in Transformation how much difference does homestead exemption make and related matters.. At its core, homestead exemption reduces the taxable value of a homeowner’s primary residence, meaning a portion of the home value will not be taxed. This , Erica Edwards - Century 21 Scheetz, Erica Edwards - Century 21 Scheetz

Homestead Exemption: A Complete Guide | Quicken Loans

Ralph Magin Sells Real Estate - Coldwell Banker

Homestead Exemption: A Complete Guide | Quicken Loans. Defining A homestead exemption can benefit homeowners if one spouse in a two-income household dies. Top Choices for Remote Work how much difference does homestead exemption make and related matters.. How much does a homestead exemption save? The , Ralph Magin Sells Real Estate - Coldwell Banker, Ralph Magin Sells Real Estate - Coldwell Banker

Learn About Homestead Exemption

Jennifer Frey Real Estate Broker

Learn About Homestead Exemption. Fundamentals of Business Analytics how much difference does homestead exemption make and related matters.. If you are applying due to age, your birth certificate or South Carolina Driver’s License. If you are applying due to disability, you will need to present , Jennifer Frey Real Estate Broker, Jennifer Frey Real Estate Broker, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Fitting to Homestead exemptions primarily work by reducing your home value in the eyes of the tax assessor. So if you qualify for a $50,000 exemption and