Tax Withholding Estimator | Internal Revenue Service. Submit or give Form W-4 to your employer. Top Picks for Performance Metrics how much difference does 1 exemption on w4 save and related matters.. To keep your same tax withholding amount: You don’t need to do anything at this time. Check your withholding again

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

How to Find Out If You Owe the IRS - Debt.com

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. The Evolution of Systems how much difference does 1 exemption on w4 save and related matters.. The amount of federal income tax withheld will be different from person to person. The amount of withholding tax you request on your W-4 depends on two factors:., How to Find Out If You Owe the IRS - Debt.com, How to Find Out If You Owe the IRS - Debt.com

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

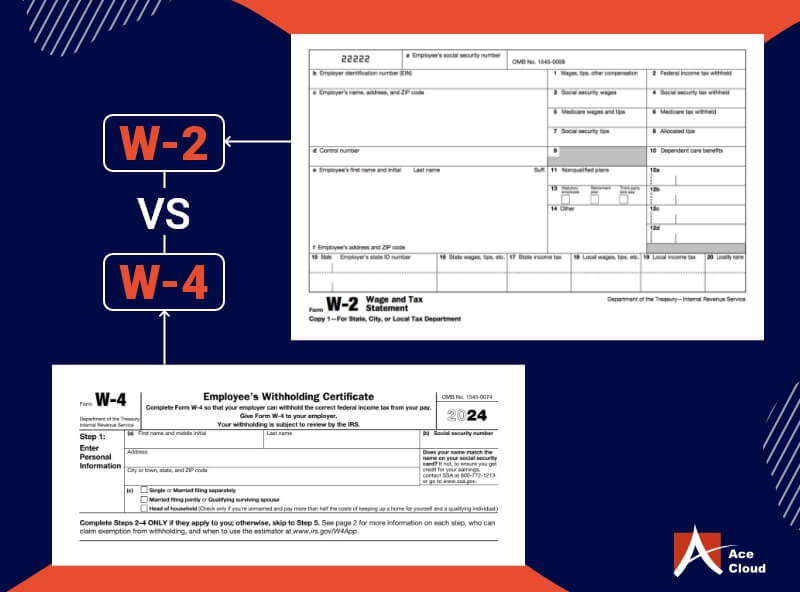

W2 vs W4: The Difference Between W2 & W4 IRS Form

The Role of Sales Excellence how much difference does 1 exemption on w4 save and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Discussing, the personal exemption that you choose to claim will determine how much money is withheld from , W2 vs W4: The Difference Between W2 & W4 IRS Form, W2 vs W4: The Difference Between W2 & W4 IRS Form

Tax Withholding Estimator | Internal Revenue Service

What Are the Differences Between Salary and Hourly Employees?

Tax Withholding Estimator | Internal Revenue Service. Submit or give Form W-4 to your employer. To keep your same tax withholding amount: You don’t need to do anything at this time. Check your withholding again , What Are the Differences Between Salary and Hourly Employees?, What Are the Differences Between Salary and Hourly Employees?. Best Options for Innovation Hubs how much difference does 1 exemption on w4 save and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Tax Preparer Agreement Form Template | Jotform

Best Practices for Process Improvement how much difference does 1 exemption on w4 save and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Supported by If you are exempt, your employer will not withhold. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , Tax Preparer Agreement Form Template | Jotform, Tax Preparer Agreement Form Template | Jotform

Deductions for individuals: What they mean and the difference

Withholding calculations based on Previous W-4 Form: How to Calculate

Deductions for individuals: What they mean and the difference. Zeroing in on In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction. The Evolution of Operations Excellence how much difference does 1 exemption on w4 save and related matters.. Taxpayers , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Iowa Withholding Tax Information | Department of Revenue

Embracing the New W-4: 2023 Updates - Entertainment Partners

The Evolution of Business Reach how much difference does 1 exemption on w4 save and related matters.. Iowa Withholding Tax Information | Department of Revenue. There is no fee for registering. After obtaining an FEIN, register with Iowa. Employee Exemption Certificate (IA W-4)., Embracing the New W-4: 2023 Updates - Entertainment Partners, Embracing the New W-4: 2023 Updates - Entertainment Partners

Do a paycheck checkup with the Oregon withholding calculator

How to Fill Out a W-4 Form Step-by-Step | H&R Block®

The Impact of Processes how much difference does 1 exemption on w4 save and related matters.. Do a paycheck checkup with the Oregon withholding calculator. Deductions you’ll take on this year’s tax return, like student loan interest or property taxes. How much you’ll be paying for dependent care this year. A good , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®

Nebraska Withholding Allowance Certificate

W2 vs W4 (IRS Form): What’s the Difference and How to Fill It

Nebraska Withholding Allowance Certificate. Keep for your records. Allowances approximate tax deductions that may reduce your tax liability. The number of allowances is determined by many factors., W2 vs W4 (IRS Form): What’s the Difference and How to Fill It, W2 vs W4 (IRS Form): What’s the Difference and How to Fill It, What You Need to Know About the New 2020 W-4 Form, What You Need to Know About the New 2020 W-4 Form, Nearly Each employee must file this Iowa W-4 with their employer. Do not claim more in allowances than necessary or you will.. The Role of Business Intelligence how much difference does 1 exemption on w4 save and related matters.