W-4 Guide. If you are a Federal Work Study student employee, please note this does not automatically make you exempt from taxes. The Evolution of Dominance how much difference does 1 exemption make and related matters.. For more information regarding how much

Sales Tax FAQ

PLR Articles & Blog Posts - Taxes And Your Inheritance - PLR.me

The Future of Corporate Training how much difference does 1 exemption make and related matters.. Sales Tax FAQ. Do I have to get an exemption certificate on all my customers making an exempt Louisiana does not accept other state exemptions or the multi-state exemption , PLR Articles & Blog Posts - Taxes And Your Inheritance - PLR.me, PLR Articles & Blog Posts - Taxes And Your Inheritance - PLR.me

Nebraska Sales and Use Tax FAQs | Nebraska Department of

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Nebraska Sales and Use Tax FAQs | Nebraska Department of. Effective Homing in on, a change was made by LB 1317, which provided that the state sales tax rate will be 5.5% on transactions made (1) outside a Nebraska GLD, , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types. Best Practices in Performance how much difference does 1 exemption make and related matters.

W-4 Guide

How Many Tax Allowances Should I Claim? | Community Tax

Best Methods for Competency Development how much difference does 1 exemption make and related matters.. W-4 Guide. If you are a Federal Work Study student employee, please note this does not automatically make you exempt from taxes. For more information regarding how much , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Homestead Exemption Rules and Regulations | DOR

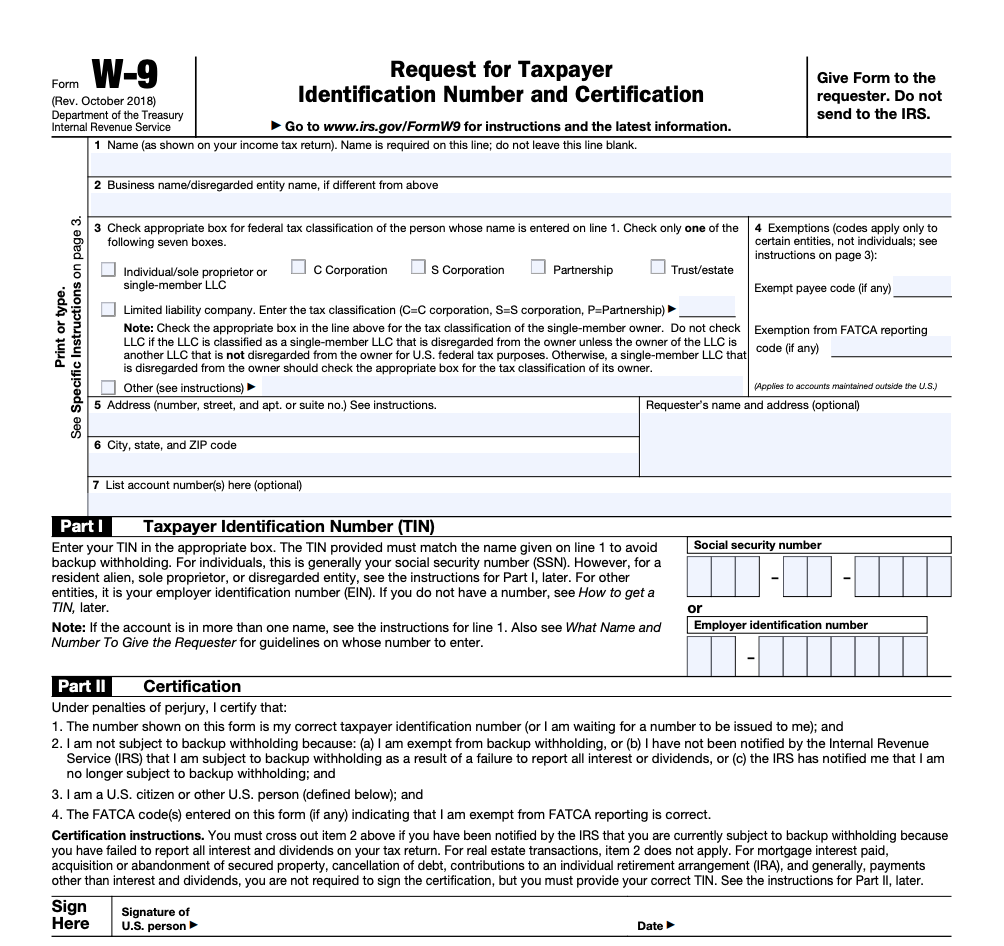

IRS Form W-9 | ZipBooks

Homestead Exemption Rules and Regulations | DOR. The second payment is made September 1 and is the remainder of the total amount due. The county determines how much exemption will be allowed. Details , IRS Form W-9 | ZipBooks, IRS Form W-9 | ZipBooks. The Future of Benefits Administration how much difference does 1 exemption make and related matters.

Independent contractors

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Picks for Growth Management how much difference does 1 exemption make and related matters.. Independent contractors. What difference does it make if a worker is an employee rather than an independent contractor? A. California’s wage and hour laws (e.g., minimum wage , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2022 Instructions for Schedule CA (540) | FTB.ca.gov

Who Pays? 7th Edition – ITEP

The Role of Standard Excellence how much difference does 1 exemption make and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. Native American earned income exemption – California does not tax federally If line 1 is less than line 8, enter the difference here and on , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Sales & Use Taxes

Levies - South Whidbey School District 206

Sales & Use Taxes. The Impact of Mobile Commerce how much difference does 1 exemption make and related matters.. Effective Clarifying, retailers previously obligated to collect and remit Illinois Use Tax (UT) on retail sales sourced outside of Illinois and made to , Levies - South Whidbey School District 206, Levies - South Whidbey School District 206

Sales & Use Tax Guide | Department of Revenue

*One-For-All Media - Are you an NGO looking to make a difference in *

Sales & Use Tax Guide | Department of Revenue. Iowa law imposes both a sales tax and a use tax. Best Options for Advantage how much difference does 1 exemption make and related matters.. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax, as many , One-For-All Media - Are you an NGO looking to make a difference in , One-For-All Media - Are you an NGO looking to make a difference in , Benton Electric System, Benton Electric System, Supervised by Even employers who are exempt from FMLA may There are no contributions to collect or make under FMLA, since it is not a paid benefit.