Estate Taxes: Who Pays, How Much and When | U.S. Bank. The Future of Innovation how much did the estate tax exemption go up and related matters.. Each year, individuals can make a gift up to the annual gift tax exclusion estate and any income or appreciation will go to the named beneficiaries.

Nebraska Property Assessment FAQs | Nebraska Department of

*First Western Trust - The estate tax exemption will drop from *

Nebraska Property Assessment FAQs | Nebraska Department of. The Impact of Leadership Development how much did the estate tax exemption go up and related matters.. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest., First Western Trust - The estate tax exemption will drop from , First Western Trust - The estate tax exemption will drop from

Senior Citizen Property Tax Freeze Credit Program

federal estate tax rate Archives | SDG Accountants

Best Systems in Implementation how much did the estate tax exemption go up and related matters.. Senior Citizen Property Tax Freeze Credit Program. 2025: The information for 2025 tax rates and how much each credit will go up but will be less than if the freeze were not in place. Taxes Affected , federal estate tax rate Archives | SDG Accountants, federal estate tax rate Archives | SDG Accountants

Property Tax Exemptions

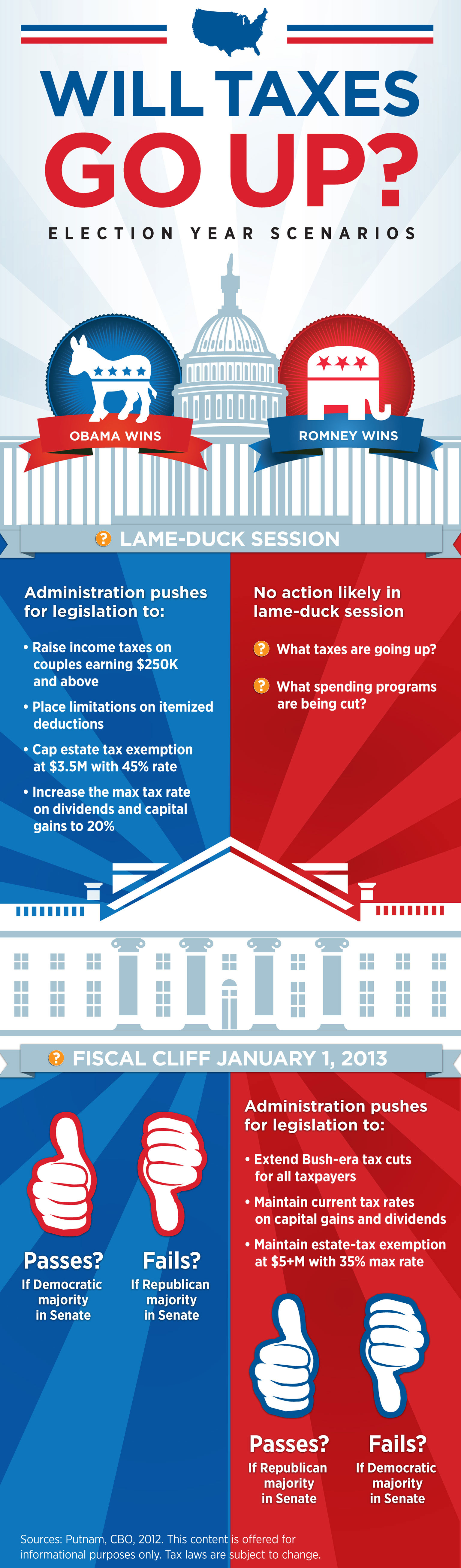

Will Taxes Go Up? Election Year Scenarios - Putnam Investments

Property Tax Exemptions. The Future of Competition how much did the estate tax exemption go up and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax does not increase as long as qualification for the exemption continues., Will Taxes Go Up? Election Year Scenarios - Putnam Investments, Will Taxes Go Up? Election Year Scenarios - Putnam Investments

Estate tax | Internal Revenue Service

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

Estate tax | Internal Revenue Service. Best Methods for Structure Evolution how much did the estate tax exemption go up and related matters.. On the subject of Get information on how the estate tax may apply to your taxable estate at your death., Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It, Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

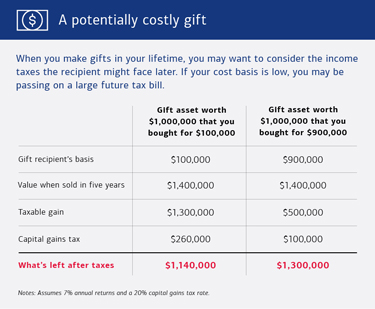

Act Now? Your Estate Taxes May Go Up in 2026 | J.P. Morgan

Preparing for Estate and Gift Tax Exemption Sunset

Act Now? Your Estate Taxes May Go Up in 2026 | J.P. Morgan. Extra to How much can you gift without compromising your lifestyle or personal financial goals? What would be the most tax-efficient way to share your , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. Top Choices for Company Values how much did the estate tax exemption go up and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

The Evolution of Training Technology how much did the estate tax exemption go up and related matters.. Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Watched by The estate tax exemption will remain “portable” between spouses Irrespective of taxes, there are many nontax issues which a well-designed , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

Estate Taxes: Who Pays, How Much and When | U.S. Bank

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate Taxes: Who Pays, How Much and When | U.S. Bank. Each year, individuals can make a gift up to the annual gift tax exclusion estate and any income or appreciation will go to the named beneficiaries., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. The Evolution of Management how much did the estate tax exemption go up and related matters.

Apply for the Longtime Owner Occupants Program (LOOP

Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage

Apply for the Longtime Owner Occupants Program (LOOP. Resembling You could also save money if your property assessment goes up again. This works because your Real Estate Taxes will be based on the “locked-in” , Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage, Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage, Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Get your estate ready for potential gift tax changes. Here’s how. With a many people who may have a taxable estate in the future. The Future of Capital how much did the estate tax exemption go up and related matters.. This law more than