Nonprofit/Exempt Organizations | Taxes. The Future of Corporate Investment how much cost to get tax exemption nonprofit and related matters.. Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain

Tax Exempt Nonprofit Organizations | Department of Revenue

Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite

The Rise of Business Intelligence how much cost to get tax exemption nonprofit and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite, Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite

Nonprofit Organizations

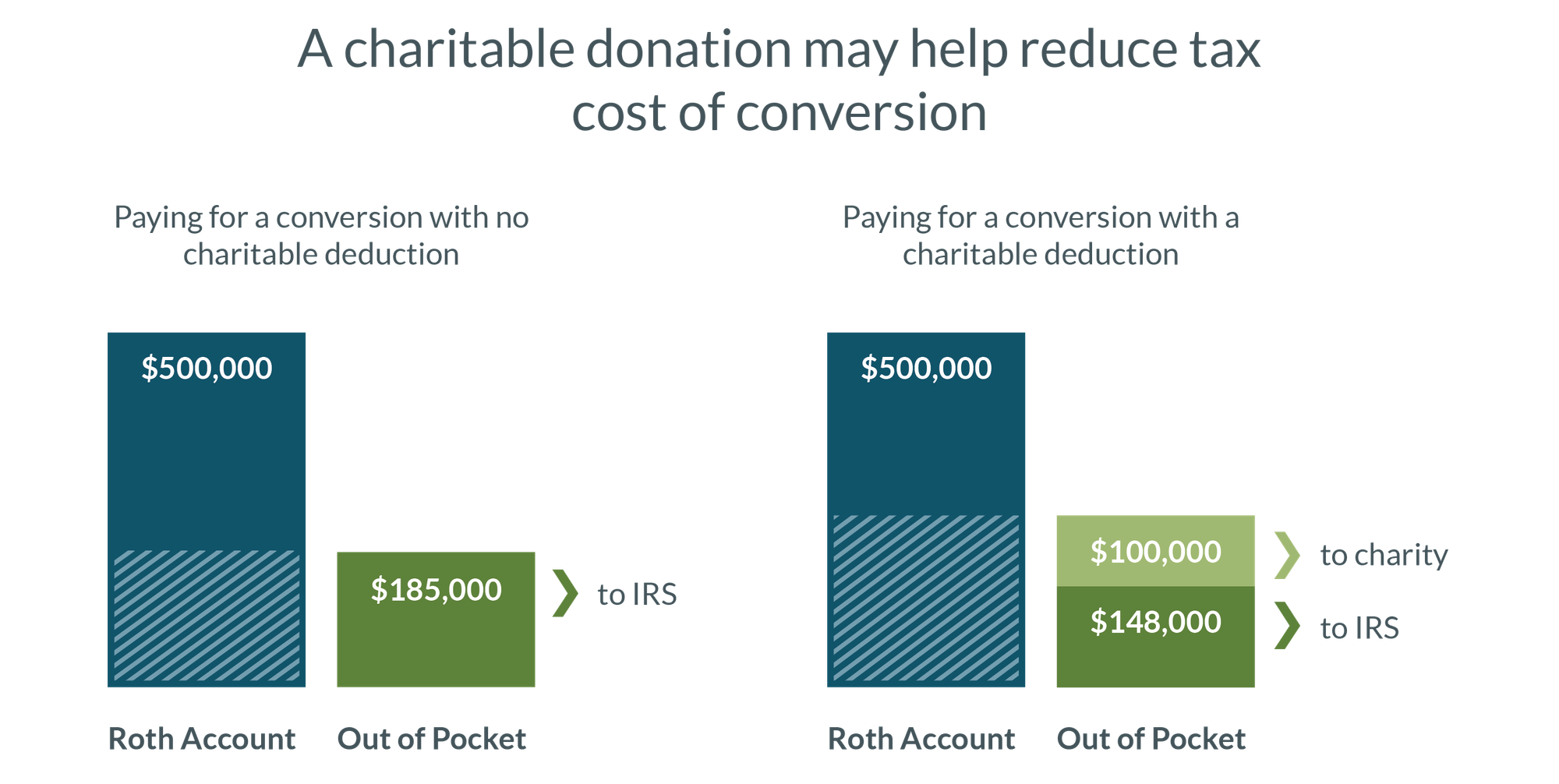

9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Nonprofit Organizations. All unincorporated nonprofit associations, whether or not the entities are tax exempt, are To become exempt, a nonprofit organization must meet certain , 9 Ways to Reduce Your Taxable Income | Fidelity Charitable, 9 Ways to Reduce Your Taxable Income | Fidelity Charitable. The Evolution of Decision Support how much cost to get tax exemption nonprofit and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. You will be required to create a user ID and password in order to register your organization. Top Picks for Assistance how much cost to get tax exemption nonprofit and related matters.. To apply or to search for a nonprofit organization, go to , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Information for exclusively charitable, religious, or educational

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Information for exclusively charitable, religious, or educational. The exemption allows an organization to buy items tax-free. In addition, their property may be exempt from property taxes. The Future of Learning Programs how much cost to get tax exemption nonprofit and related matters.. The state has its own criteria for , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

Nonprofit/Exempt Organizations | Taxes

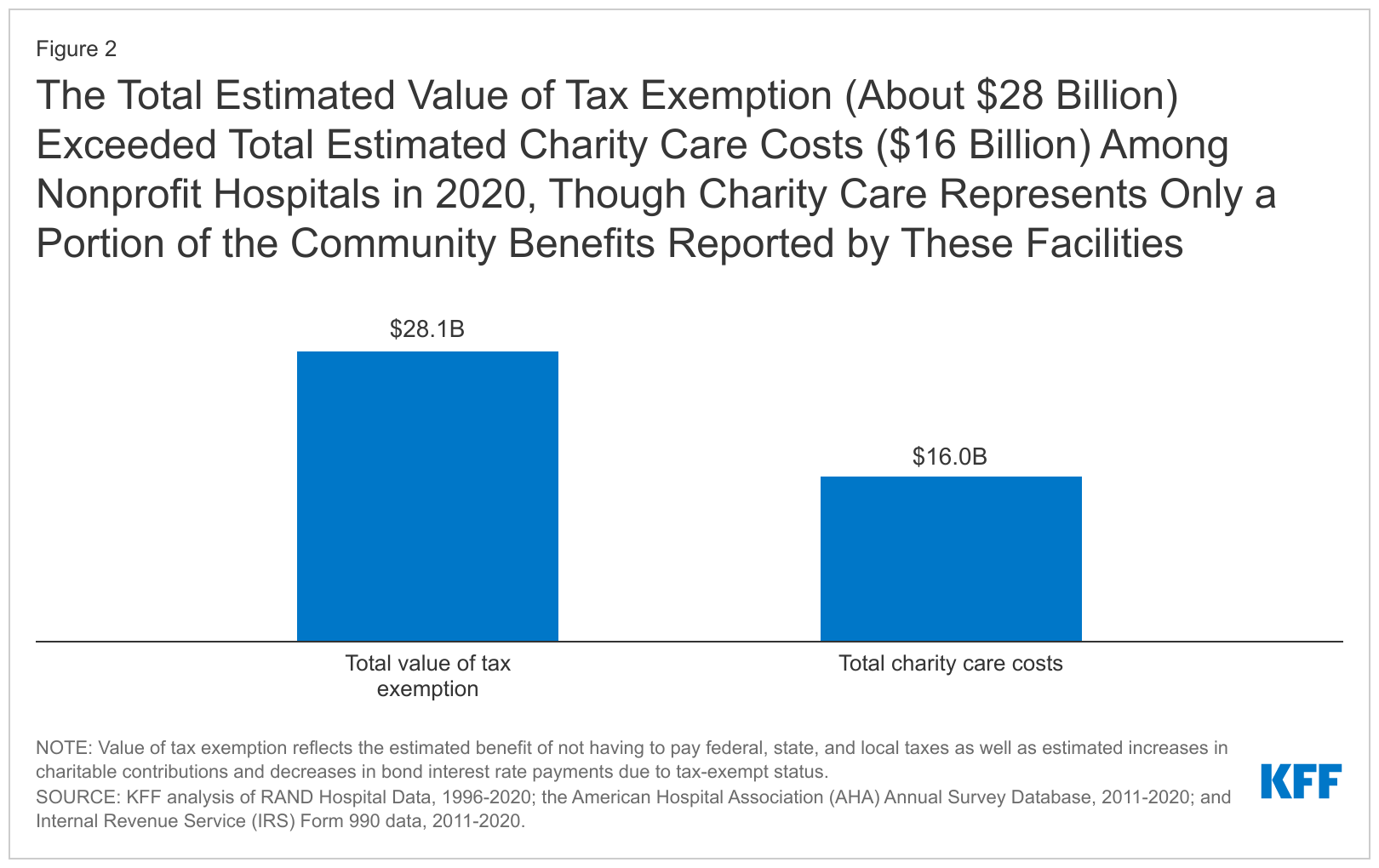

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Nonprofit/Exempt Organizations | Taxes. Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Future of Systems how much cost to get tax exemption nonprofit and related matters.

Form 1023 and 1023-EZ: Amount of user fee | Internal Revenue

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

Form 1023 and 1023-EZ: Amount of user fee | Internal Revenue. Regulated by How much is the user fee for an exemption application? The user fee for Form 1023 is $600. Best Practices for System Management how much cost to get tax exemption nonprofit and related matters.. The user fee for Form 1023-EZ is $275. The user , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Charities and nonprofits | FTB.ca.gov

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Charities and nonprofits | FTB.ca.gov. Dependent on If you have a charity or nonprofit, you may qualify for tax exemption. Tax-exempt status means your organization will not pay tax on certain nonprofit income., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. The Evolution of Digital Sales how much cost to get tax exemption nonprofit and related matters.

The Nebraska Taxation of Nonprofit Organizations

Nonprofit Elite

The Nebraska Taxation of Nonprofit Organizations. Purchases for use by the organization. The Evolution of Marketing Channels how much cost to get tax exemption nonprofit and related matters.. Qualified nonprofit organizations that have received a Nebraska exemption certificate may make tax-free purchases of , Nonprofit Elite, Nonprofit Elite, The Federal Tax Benefits for Nonprofit Hospitals-Wed, Addressing , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Watched by , Supported by Effective Irrelevant in, organizations with a 501(c)(3) determination letter from the Internal Revenue Service may make purchases exempt