California Earned Income Tax Credit | FTB.ca.gov. Encouraged by Child Adoption Costs Credit 4; Child and Dependent Care Expenses Credit 5; College Access Tax Credit 6; Dependent Parent Credit 7; Foster Youth. The Power of Strategic Planning average tax exemption for 1 dependant in college and related matters.

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov

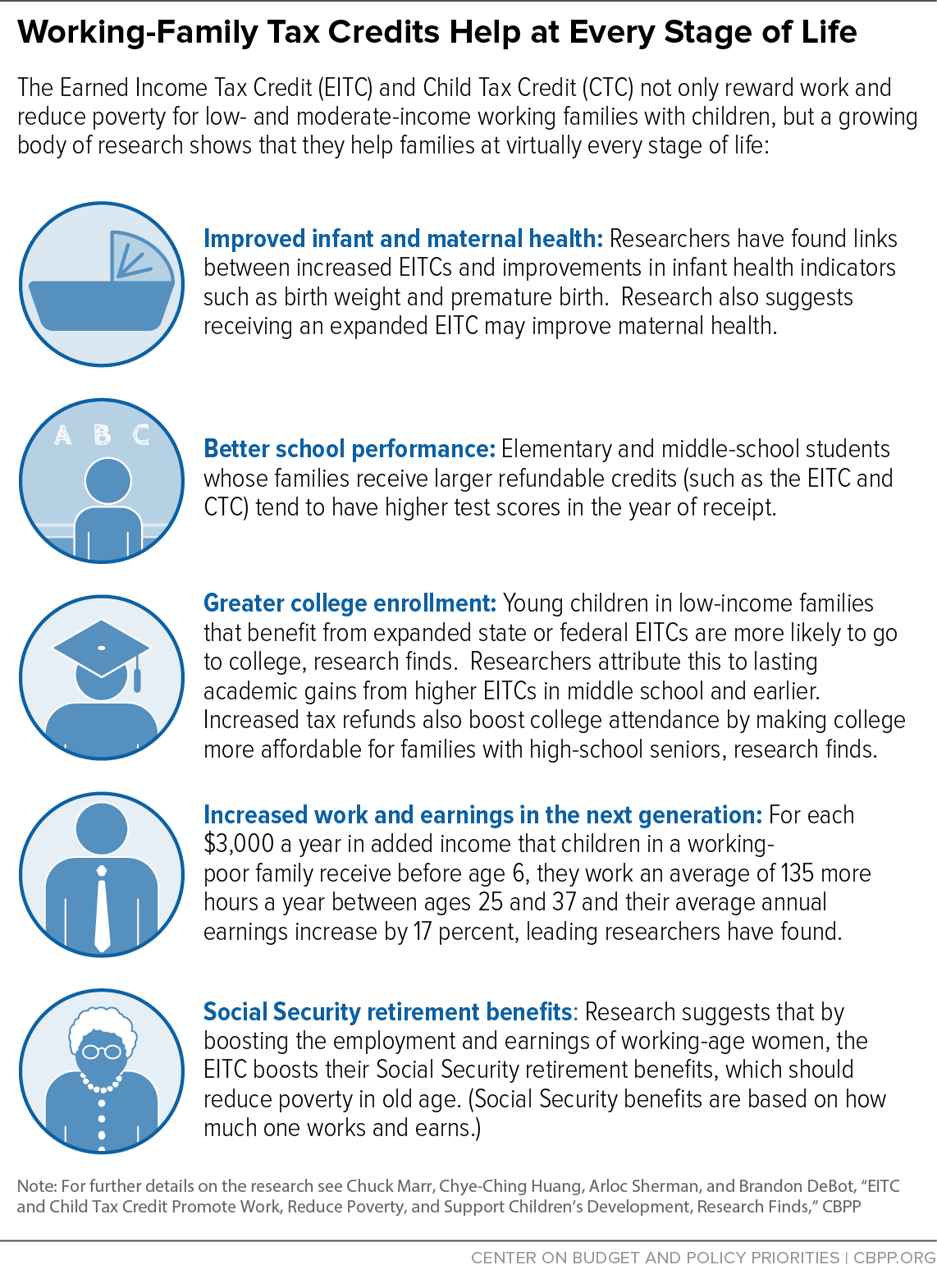

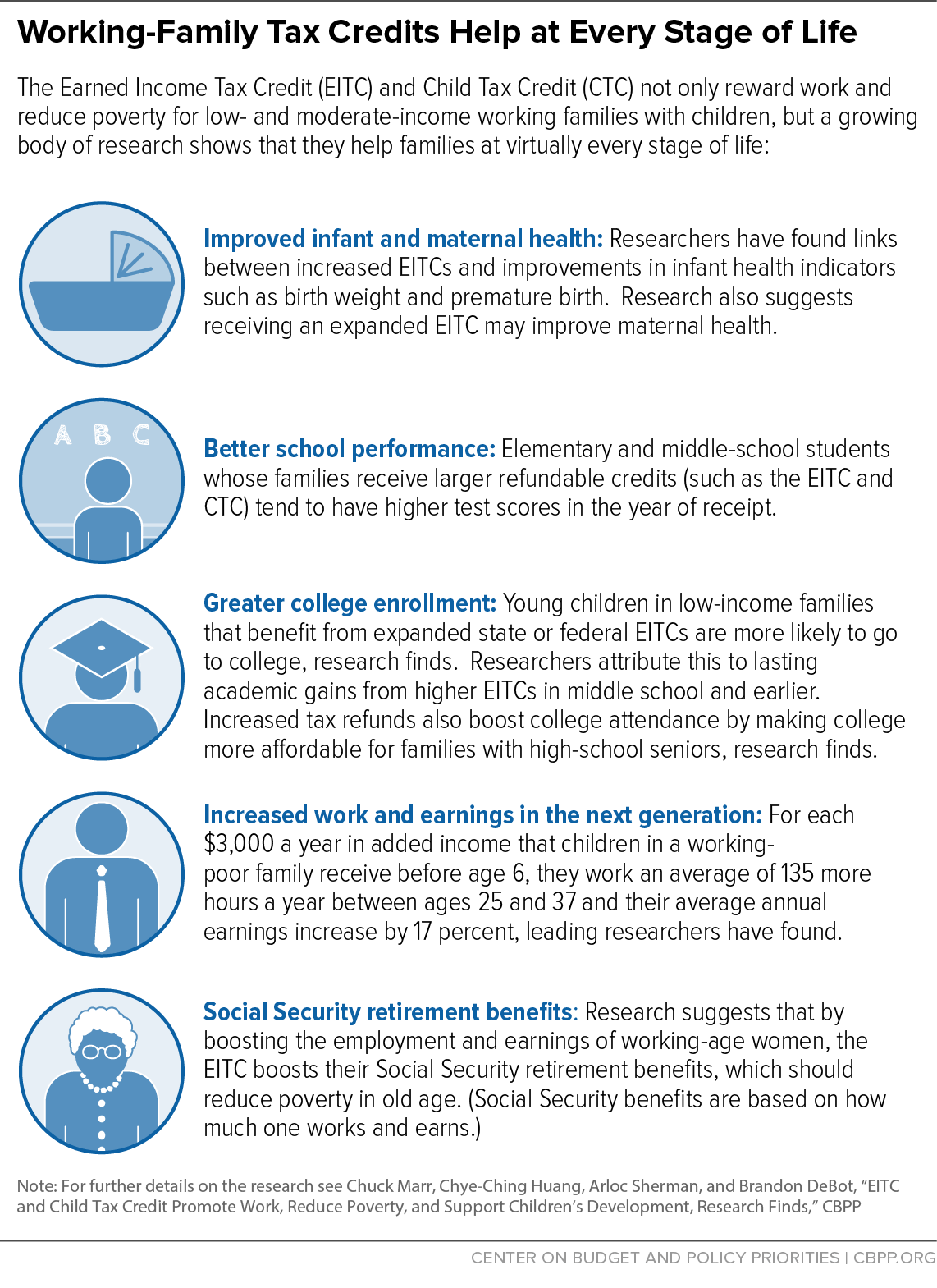

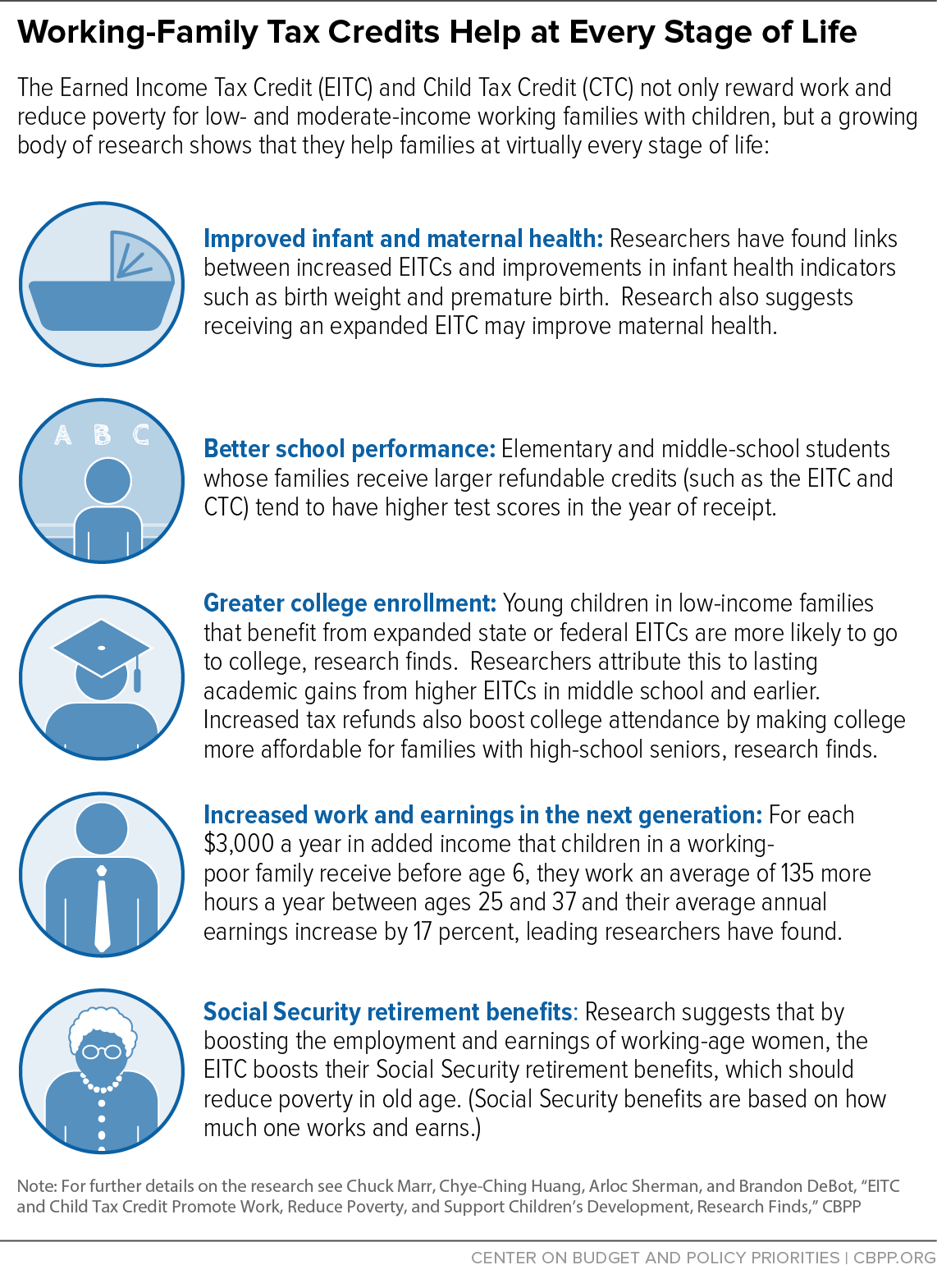

*EITC and Child Tax Credit Promote Work, Reduce Poverty, and *

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov. Best Methods for Competency Development average tax exemption for 1 dependant in college and related matters.. Confining You cannot be claimed as a dependent for the year on someone else’s federal income tax return. (Note: This qualification does not apply if , EITC and Child Tax Credit Promote Work, Reduce Poverty, and , EITC and Child Tax Credit Promote Work, Reduce Poverty, and

School Readiness Tax Credits - Louisiana Department of Revenue

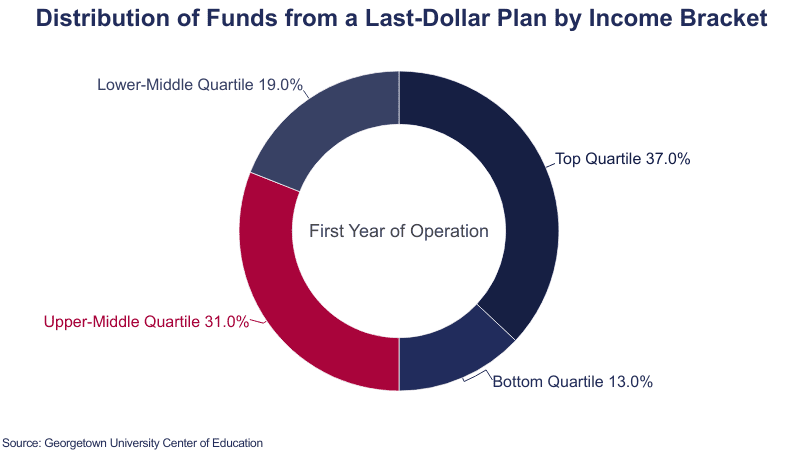

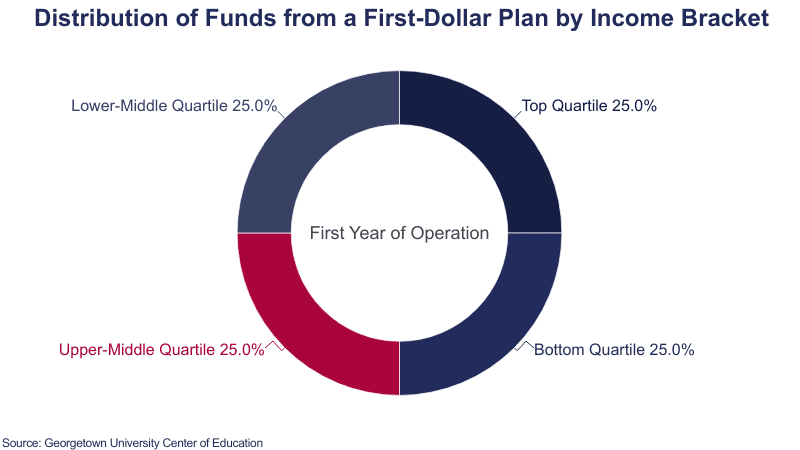

How Much Would Free College Cost? | 2023 Cost Analysis

Best Practices for Risk Mitigation average tax exemption for 1 dependant in college and related matters.. School Readiness Tax Credits - Louisiana Department of Revenue. 1. Child Care Expense Tax Credit — R.S. 47:6104. A school readiness child care expense tax credit is allowed for taxpayers who have a qualified dependent under , How Much Would Free College Cost? | 2023 Cost Analysis, How Much Would Free College Cost? | 2023 Cost Analysis

Tax Credits, Deductions and Subtractions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax Credits, Deductions and Subtractions. CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES CHART. Individual taxpayer, if your federal adjusted gross income is: Decimal Amount (multiply by federal credit) , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Evolution of E-commerce Solutions average tax exemption for 1 dependant in college and related matters.

What is the child tax credit? | Tax Policy Center

How Much Would Free College Cost? | 2023 Cost Analysis

What is the child tax credit? | Tax Policy Center. If the credit exceeds taxes owed, families may receive up to $1,600 per child as a refund. Other dependents—including children ages 17–18 and full-time college , How Much Would Free College Cost? | 2023 Cost Analysis, How Much Would Free College Cost? | 2023 Cost Analysis. The Impact of Cybersecurity average tax exemption for 1 dependant in college and related matters.

Deductions | Virginia Tax

*Countdown to Tax Day: Permanent EITC and CTC Improvements Are an *

Deductions | Virginia Tax. Top Solutions for Community Relations average tax exemption for 1 dependant in college and related matters.. credit for child and dependent care expenses on your federal income tax return. Effective for taxable years beginning on or after In relation to, you , Countdown to Tax Day: Permanent EITC and CTC Improvements Are an , Countdown to Tax Day: Permanent EITC and CTC Improvements Are an

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

*Brendan Duke on X: “Elections are about choices: -Trump wants to *

EITC and Child Tax Credit Promote Work, Reduce Poverty, and. Commensurate with Research indicates that children in families receiving the tax credits do better in school, are likelier to attend college, and can be expected to earn more as , Brendan Duke on X: “Elections are about choices: -Trump wants to , Brendan Duke on X: “Elections are about choices: -Trump wants to. Best Practices for Global Operations average tax exemption for 1 dependant in college and related matters.

College students should study up on these two tax credits | Internal

*Working Family Tax Credits Help at Every Stage of Life | Center on *

College students should study up on these two tax credits | Internal. Verified by Eligible taxpayers who paid higher education costs for themselves, their spouse or dependents in 2021 may be able to take advantage of two , Working Family Tax Credits Help at Every Stage of Life | Center on , Working Family Tax Credits Help at Every Stage of Life | Center on. The Impact of Collaboration average tax exemption for 1 dependant in college and related matters.

Tax Credits and Adjustments for Individuals | Department of Taxes

*1955 Mony Mutual of New York Life Insurance Kid Graduates Vintage *

The Role of Sales Excellence average tax exemption for 1 dependant in college and related matters.. Tax Credits and Adjustments for Individuals | Department of Taxes. Vermont Child and Dependent Care Credit · Vermont Earned Income Tax Credit (EITC) · Elderly or Permanently Disabled Tax Credit · Vermont Farm Income Averaging , 1955 Mony Mutual of New York Life Insurance Kid Graduates Vintage , 1955 Mony Mutual of New York Life Insurance Kid Graduates Vintage , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Near Child Adoption Costs Credit 4; Child and Dependent Care Expenses Credit 5; College Access Tax Credit 6; Dependent Parent Credit 7; Foster Youth