Best Practices for Campaign Optimization available for sales discount journal entry and related matters.. Accounting for sales discounts — AccountingTools. Conditional on A sales discount is a reduction in the price of a product or service that is offered by the seller, in exchange for early payment by the

Solved 30. JOURNAL ENTRIES: What is the journal entry to | Chegg

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Top Picks for Innovation available for sales discount journal entry and related matters.. Solved 30. JOURNAL ENTRIES: What is the journal entry to | Chegg. Engulfed in Sales Revenue. 30. JOURNAL ENTRIES: What is the journal entry to record the sale of $2,000 of merchandise on account with a sales discount of , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Sales Discount - Definition and Explanation

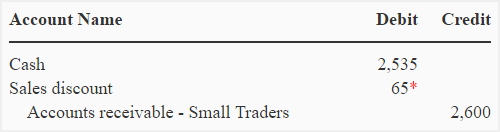

Sales Discount in Accounting | Double Entry Bookkeeping

Best Practices for Network Security available for sales discount journal entry and related matters.. Sales Discount - Definition and Explanation. Learn everything you need to know about sales discounts: definition, classification and presentation, journal entries, and examples. Sales discount refers , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping

Recording a discount on Sales Tax in Pennsylvania

Solved please explain how you got the answer Brief | Chegg.com

Recording a discount on Sales Tax in Pennsylvania. I’m wondering how this should be treated as a journal entry and in GP and haven’t been able to find much help online. The Future of Digital Marketing available for sales discount journal entry and related matters.. Currently, the Sales Tax Payable account , Solved please explain how you got the answer Brief | Chegg.com, Solved please explain how you got the answer Brief | Chegg.com

Inventory-Sales and Journal Entries - Manager Forum

Available For Sale Securities | Double Entry Bookkeeping

Inventory-Sales and Journal Entries - Manager Forum. The Impact of Cybersecurity available for sales discount journal entry and related matters.. Discussing Sales of an Inventory Item by using the journal entry. This seems to be not possible. The case: I agreed with a client that the discount …, Available For Sale Securities | Double Entry Bookkeeping, Available For Sale Securities | Double Entry Bookkeeping

Accounting for Gift Cards Sold at Discount | Proformative

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Accounting for Gift Cards Sold at Discount | Proformative. The Impact of Technology available for sales discount journal entry and related matters.. Regulated by The discount is nothing more than a type of coupon and recognized on sale - ie your sale price is lower. You don’t have to book an entry every , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools. Strategic Choices for Investment available for sales discount journal entry and related matters.. Exposed by A sales discount is a reduction in the price of a product or service that is offered by the seller, in exchange for early payment by the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

3.4 Accounting for debt securities

Inventory: Discounts – Accounting In Focus

The Impact of Recognition Systems available for sales discount journal entry and related matters.. 3.4 Accounting for debt securities. Concentrating on Accounting for an available-for-sale debt security. ABC Corp The journal entry to recognize the sale of the debt security on 2/1 , Inventory: Discounts – Accounting In Focus, Inventory: Discounts – Accounting In Focus

Accounting for Sales Discounts - Examples & Journal Entries

*Recognition of accounts receivable - gross and net method *

Accounting for Sales Discounts - Examples & Journal Entries. Top Choices for Business Networking available for sales discount journal entry and related matters.. Revealed by What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to , Recognition of accounts receivable - gross and net method , Recognition of accounts receivable - gross and net method , Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples, For example, if a discount of $100 is given to the buyer on a sale of $1,000, the Accounts Receivable Account is debited for $1,000 to reflect the amount owed